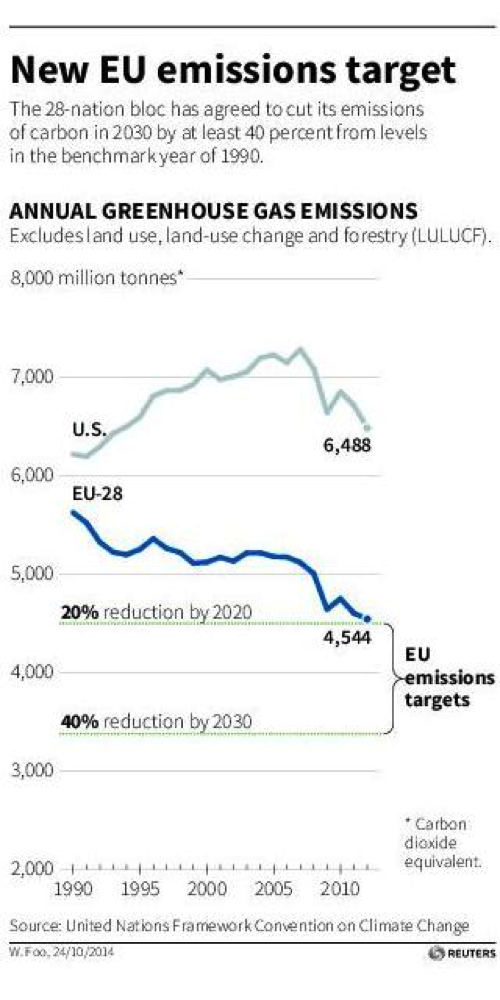

A decision announced last week by European leaders to slash their countries’ greenhouse gas emissions 40 percent below 1990 levels by 2030 poses a serious dilemma for the 28-nation bloc that signed on.

The deal was hailed by government leaders and some environmentalists as an important step towards combatting climate change and a good example for other world leaders set to meet next year in Paris to try to hammer out an international climate agreement.

Related: How Climate Change Costs Could Soar to the Billions

"It was not easy, not at all, but we managed to reach a fair decision," said European Council President Herman Van Rompuy, according to the Associated Press. "It sets Europe on an ambitious yet cost-effective climate and energy path."

The decision comes at a time when many countries in Europe, Asia and the rest of the world are struggling with an economic slowdown that could push them back into a recession.

The International Monetary Fund recently downgraded its outlook this year because Germany, France and other European countries are at risk of slipping into another recession and because persistent weakness is slowing Japan, China and Brazil.

The IMF described the recovery as uneven and it pegged global growth this year at 3.3 percent, or one-tenth of a percentage point below its July forecast.

Related: As Global Economy Sputters, U.S. Growth Is Jeopardized

Meanwhile, a recent Brookings Institute survey of the global economy described the United States as “the sole major economy still showing signs of strength.” Eswar Prasad, a Cornell University economist and one of the authors of the report, said, “The world still seems to be counting on riding the coattails of the U.S. economy. That is not going to produce a sustainable recovery.”

The specter of European countries forging ahead with its anti-climate change initiatives while their economies are heading into the tank encapsulates a dilemma that has bedeviled industrialized and emerging economies for years.

Even as they reached this major global warming accord, elements of the agreement were “watered down” to account for countries like Poland that rely on carbon-heavy coal, and for nations like Britain that were unwilling to embrace new, tough requirements for switching to renewable sources of energy, the New York Times reported.

Fears of literally ruining the environment and fueling costly and lethal natural catastrophes by continuing to depend on fossil fuels for much of their energy collide with worries that a carbon tax or other schemes to reduce consumption will drive up energy costs for average people and eliminate many jobs in the industrial and utility sectors.

Related: The Pros and Cons of Obama’s New Carbon Rule

Chris Warren, communications director for the industry backed Institute for Energy Research, argues that proposals for reducing carbon emissions ranging from a cap-and-trade scheme to a consumer tax to tougher Environmental Protection rules for power plant emissions all would hurt the economy and jobs.

“All of these proposals – whatever you call them – will increase electricity rates,” Warren said in an interview. “There’s no way getting around that. People that are most impacted by that are usually lower-income people or people on fixed income or larger families, because they spend a greater portion of their income on electricity and energy costs in general.”

“You look at the countries whose economies have been growing in recent years – like China and India – and they’re burning a lot of coal and a lot of natural gas and oil to get [ahead] just as developed countries in the West have done. They’re not going to risk their economies and the livelihood of their people in the name of reducing C02 emissions.”

But others strongly disagree.

Related: India’s Resistance to Climate Change Gives Way to Deal

“The global climate change is a massive, looming problem that the world has not addressed – neither the developing world nor the undeveloped world, and we need to commit to reducing emissions over time, clearly,” said Alice Rivlin, a former Clinton-era White House budget director and chief of the Congressional Budget Office.

“Drastic action to reduce carbon emissions certainly would [slow economic growth], but gradual actions over time – things enacted now that take effect over time such as carbon taxes – would doubtless help no matter how fast the economy recovers,” she said.

Two reports released earlier this month by Climate Policy Initiative argue that a move to clean-energy, low-carbon government policies to mitigate the impact of global warming could actually provide a boost to the economy. The studies content that that moving to those types of policies could save the global economy trillions of dollars in the next two decades to invest in economic growth.

“For policymakers around the world wondering whether the transition to a low-carbon economy will help or hurt their countries’ ability to invest for growth, our analysis clearly demonstrates that, for many, the low-carbon transition is a no-brainer,” said Tom Heller, Climate Policy Initiative’s executive director. “It not only reduces climate risks, its benefits are clear and significant.”

Related: Obama Fights Global Warming, One Hot Spot at a Time

This debate has played out for two decades in Washington, where conservative Republicans and their allies in the business community repeatedly collided with environmental advocates. More often than not, the conservative forces have come out on top, especially during the administration of Republican president George W. Bush, who pulled out of the Kyoto treaty on climate change in 2005, saying it would have “wrecked” the U.S. economy.

President Obama and his Democratic allies in Congress tried but failed early in Obama’s first term to pass a cap-and-trade program that would allow industries and businesses to purchase and trade pollution credits while staying within a relatively strict cap on overall carbon emissions.

Related: Will $50 Million Move the Needle on Climate Change?

Obama has taken a series of unilateral steps – including promulgating EPA rules to cut back on power plant and car emissions – with no help from Congress. While the idea of cap-and-trade has been dormant for years, Tom Steyer, the billionaire San Francisco financier who is bankrolling a major push for Democratic Senate candidates in the mid-term campaign, is urging lawmakers and governors to get behind a new iteration of cap-and-trade.

Europe for years has been far ahead of the United States and other countries in moving towards a “green” economy that is driven more by renewable energy sources than coal and gas – but with mixed results.

After almost a decade of heated political debate, Australia last July became the first developed nation to repeal carbon laws that put a price on greenhouse-gas emissions, according to The Wall Street Journal. Australia's Senate voted 39-32 to repeal a politically divisive carbon emissions price that contributed to the undoing of three Australian leaders since it was first suggested in 2007, The Journal reported.

Australia has the world's 12th largest economy and is one of the world's largest per capita greenhouse gas emitters because of its reliance on coal-burning power stations. The former Labor government that pioneered the carbon tax argued that the move would cut emissions by 160 million metric tons by 2020.

Related: Greenhouse Emissions Have Hit a New Record

The measure offered voters billions of dollars in compensation through tax breaks and welfare payments for increased costs “stemming from one of the most dramatic reforms ever attempted in the energy-reliant economy,” according to The Journal.

After the global financial crisis struck in 2008 and a decade-long mining boom ended, the economy slowed and many jobs disappeared. That’s when Australian voters rejected the climate laws and the politicians who supported them.

Top Reads from The Fiscal Times: