Millennials Still Don’t Trust the Stock Market

Goldman Sachs has released the latest in a long line of surveys about millennials and money. The findings won’t shock you if you’ve seen other such surveys: millennials get financial advice from their parents, they’re less concerned with privacy, they still want to own a home … someday.

But one familiar finding may be worth highlighting. Even as the stock market reaches record highs, millennials by and large remain wary of investing. Fewer than 20 percent of those surveyed by Goldman said that stocks are “the best way to save for the future.” Another 45 percent said they’re willing to dip a toe in the market or to put money into low-risk options. More than a third of those surveyed said they don’t know enough about stocks or felt that the market is too volatile or too stacked against small investors.

Part of that may because many millennials haven’t yet reached the life stage or the level of financial stability that would lead them to consider investing. But the lingering scars of the recession are evident in the results, too — and financial institutions clearly have a long way go to restore the public’s confidence in them. For example, Gallup just published a report called, “Why It’s Still Cool to Hate Banks.”

Related: The Rise of a New Economic Underclass—Millennial Men

Goldman didn’t release the details about how many millennials it surveyed or when (and it hadn’t yet responded to an email asking for those details by the time of publication), but the results it got are broadly in line with those of earlier surveys. And they’re another reminder that not everyone is benefitting from the stock market’s record-setting rally. Millennials are still missing out.

Here is a chart produced by Goldman Sachs summarizing the results of their survey:

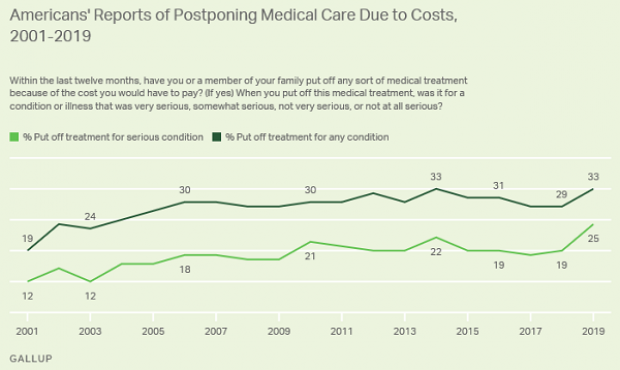

Increasing Number of Americans Delay Medical Care Due to Cost: Gallup

From Gallup: “A record 25% of Americans say they or a family member put off treatment for a serious medical condition in the past year because of the cost, up from 19% a year ago and the highest in Gallup's trend. Another 8% said they or a family member put off treatment for a less serious condition, bringing the total percentage of households delaying care due to costs to 33%, tying the high from 2014.”

Number of the Day: $213 Million

That’s how much the private debt collection program at the IRS collected in the 2019 fiscal year. In the black for the second year in a row, the program cleared nearly $148 million after commissions and administrative costs.

The controversial program, which empowers private firms to go after delinquent taxpayers, began in 2004 and ran for five years before the IRS ended it following a review. It was restarted in 2015 and ran at a loss for the next two years.

Senate Finance Chairman Chuck Grassley (R-IA), who played a central role in establishing the program, said Monday that the net proceeds are currently being used to hire 200 special compliance personnel at the IRS.

US Deficit Up 12% to $342 Billion for First Two Months of Fiscal 2020: CBO

The federal budget deficit for October and November was $342 billion, up $36 billion or 12% from the same period last year, the Congressional Budget Office estimated on Monday. Revenues were up 3% while outlays rose by 6%, CBO said.

Hospitals Sue to Protect Secret Prices

As expected, groups representing hospitals sued the Trump administration Wednesday to stop a new regulation would require them to make public the prices for services they negotiate with insurers. Claiming the rule “is unlawful, several times over,” the industry groups, which include the American Hospital Association, say the rule violates their First Amendment rights, among other issues.

"The burden of compliance with the rule is enormous, and way out of line with any projected benefits associated with the rule," the suit says. In response, a spokesperson for the Department of Health and Human Services said that hospitals “should be ashamed that they aren’t willing to provide American patients the cost of a service before they purchase it.”

See the lawsuit here, or read more at The New York Times.

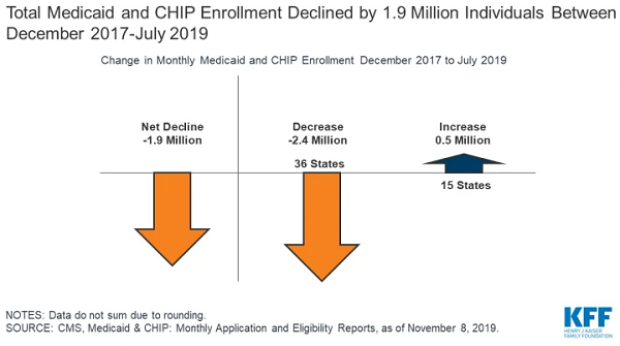

A Decline in Medicaid and CHIP Enrollment

Between December 2017 and July 2019, enrollment in Medicaid and the Children's Health Insurance Program (CHIP) fell by 1.9 million, or 2.6%. The Kaiser Family Foundation provided an analysis of that drop Monday, saying that while some of it was likely caused by enrollees finding jobs that offer private insurance, a significant portion is related to enrollees losing health insurance of any kind. “Experiences in some states suggest that some eligible people may be losing coverage due to barriers maintaining coverage associated with renewal processes and periodic eligibility checks,” Kaiser said.