Like just about everything else in our crazy, mixed up world, the business life cycle has sped up dramatically over the last 30 years.

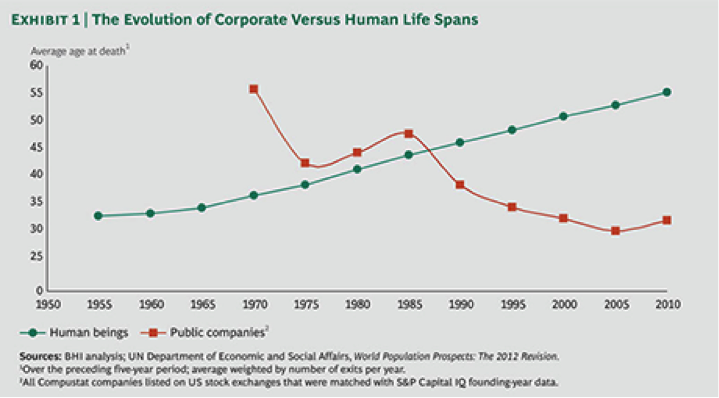

The Boston Consulting Group recently published an analysis of growth patterns for 35,000 publicly listed U.S. companies since 1950. It found that — whether because of bankruptcy, mergers or other reasons — public companies have a shorter life span than ever. “In fact,” the report says, “businesses are dying at a much younger age than the people who run them.”

The average public company dies, at least as an independent publicly listed entity, after around 30 years — far shorter than it had been in the mid-1980s. “Interestingly, most types of businesses in most industries are now dying younger,” BCG’s Martin Reeves and Lisanne Pueschel wrote last month. “Only a few make it into their fifties and sixties.”

Related: The 10 Fastest-Growing Jobs Right Now

Businesses aren’t just dying off sooner — “they are also more likely to perish at any point in time,” the report says. Almost one in 10 public companies fails each year, which is a fourfold increase since 1965.

Companies now face a roughly one in three chance of not surviving five years, up from about one in 20 a half-century ago. And those risks aren’t just in the fast-changing tech sector; they’re present across most industries and affect large companies as well as small ones, though turnover for older companies leveled off in the 2000s. “There are no safe harbors,” the report warns.

The BCG team attributes these dramatic changes to a wave of smaller and younger, venture-backed companies that went public from the mid-1980s to the late 1990s. Those companies had a much higher than average risk of failure — but the ones that survived and grew then drove up the death rate for established competitors who didn’t respond quickly enough to their new challengers. The bigger, more established companies also went on acquisition sprees, buying up smaller businesses that could help them in the new environment. That, again, meant more individual companies disappeared.

Related: 10 Best Cities to Start a Business

The report offers some advice for companies and executives looking to build lasting success on their own: watch for warnings and signs of vulnerabilities, make sure your strategic approach suits your industry and business environment, look to reinvent your business continuously to keep up with changes, don’t let a focus on the short term cause you to lose long-term perspective, and know when it’s time to go: “If a company cannot achieve sustained performance, it shouldn’t persist just for the sake of it. A successful exit may be better than languishing and slowly burning up resources.”

You can see the full BCG piece here.