You’ve likely heard over and over how the recession left college graduates clawing to land low-wage retail jobs or serving up lattes at the corner coffee spot. A new report concludes that all those tales of post-college woe are misleading, or at least not representative of the kinds of jobs that have been created in the recovery.

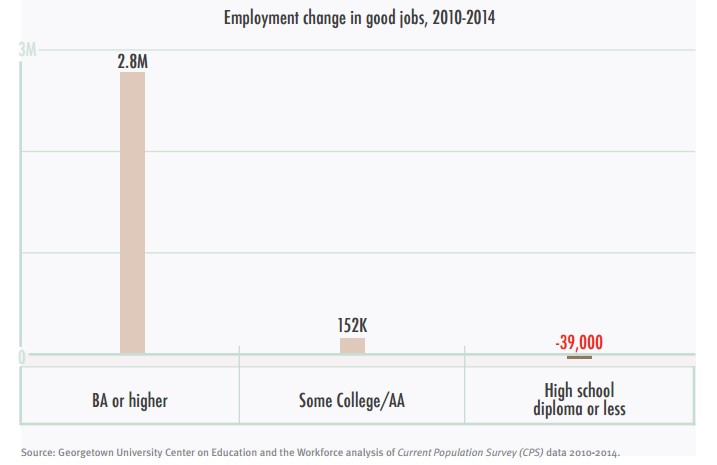

Nearly half of the 6.6 million jobs added by the economy since 2010 are “good jobs,” the report from the Georgetown University Center on Education and the Workforce finds — positions that paid at least $53,000 for full-time workers and usually provide benefits like health insurance and retirement plans. Of the 2.9 million good jobs created, 86 percent are full-time, 68 percent offer health insurance, and 61 percent provide an employer-sponsored retirement plan. Almost all of those good jobs, 2.8 million or 97 percent, went to college grads.

Related: The 10 Fastest-Growing Jobs Right Now

“Many media accounts suggest the nation is flooded with baristas who were trained to create business plans and Uber drivers who can solve differential equations,” the report says. “Certainly such overqualified workers exist, as they would in any economy, but we find they are the exception, not the norm. The surge in hiring is not concentrated in dead-end McJobs.”

The study found that jobs for mangers, health care workers and those is science, technology, engineering and mathematics have dominated the recovery. It also found that “good jobs” were the first to come back after the recession, contrary to earlier studies. Research by the National Employment Law Project, for example, had found that low-wage jobs were the first to come back and represented a disproportionate share of the job gains in the wake of the recession.

Related: The Clearest Sign That the Job Market Hasn’t Really Recovered

The different findings may be rooted in the different methodologies used to define the new jobs being created. The NELP looked at industry trends and labeled the jobs being created and low-, mid- or high-wage based on median hourly wages in those industries. The Georgetown study looked at the job growth across specific occupations. “If only the industry average earnings are used to sort jobs, then everyone from the CEO to a janitor who works at the same firm is assigned the same average pay,” the report explains.

The new report does, however, confirm another finding from past studies — namely, that middle-wage jobs have not recovered from the recession. The economy has added 1.9 million middle-wage jobs (those paying $32,000 to 53,000) in the recovery, of which 80 percent were full time, 54 percent had health insurance, and 46 percent had a retirement plan.

Related: You’re Richer Than You Think. Really.

But while all the good and low-wage jobs lost in the recession have been fully recovered, the economy needs to add another 900,000 jobs middle-wage jobs to get back to pre-recession employment levels, according to the report. That may spell trouble for skilled laborers with only a high-school degree.

“The numbers are clear: postsecondary education is important for gaining access to job opportunities in the current economy,” the Georgetown report says, “and job seekers with Bachelor’s degrees or higher have the best odds of securing good jobs.”