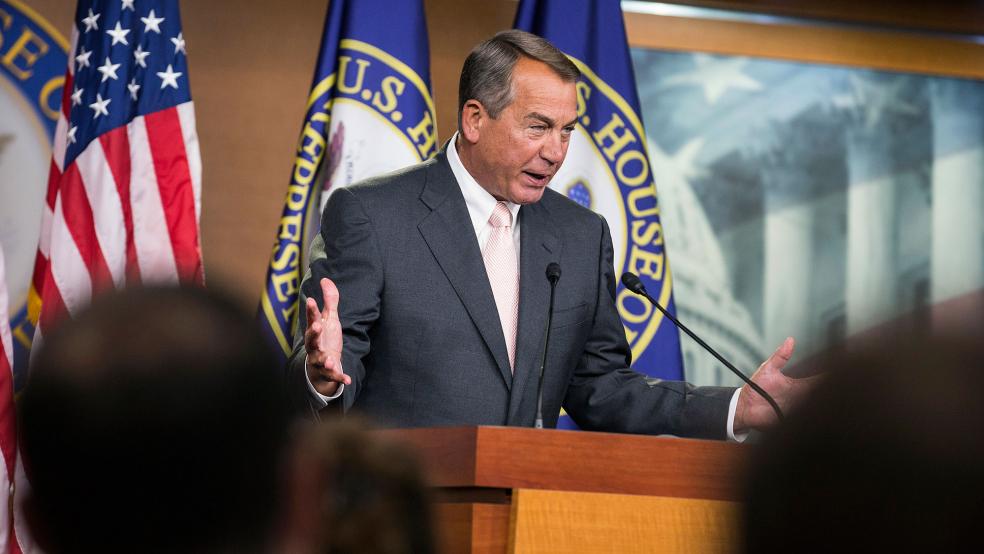

Speaker John Boehner’s announcement that he will be resigning next month is, in the words of Democratic Leader Nancy Pelosi, “seismic to the House.” But it could also shake up the stock market if it injects additional uncertainty into congressional efforts to reach a deal on the budget and debt ceiling.

That uncertainty might come into play as soon as next week, as Congress needs to pass a continuing resolution to authorize federal spending at 2015 levels by the end of the month to avert a partial government shutdown. Boehner’s resignation reportedly makes such legislation more likely to pass, giving a victory to conservatives who had been pushing for a fight over funding for Planned Parenthood.

Related: House Speaker Boehner to Resign House Speakership on October 30

But that stopgap measure might not do much to prevent another budget and debt ceiling showdown, or Republican infighting over strategy, beyond the end of the month. “The shock announcement that Republican House Speaker John Boehner will retire in October has increased the odds of a shutdown, if not this week then in early December,” Paul Ashworth, chief U.S. economist at Capital Economics, wrote to clients on Friday.

A continuing resolution would simply delay the fight until late November or December, by which time the debt ceiling would also need to be addressed. The government recently hit that $18.1 trillion limit, and the Treasury Department is again performing a financial juggling act to prevent a default, but those accounting maneuvers can’t go on indefinitely.

Election-year pressures — the notion that Republicans don’t want to be blamed by voters for another shutdown — might also cut the other way. “Not only is there a multitude of Republican presidential nominees looking for a boost among the party’s base, but all of the House representatives and a third of the Senate will be up for election next year,” Ashworth notes. “Republicans will be under pressure to play hard ball to avoid nomination fights against more conservative candidates. Boehner’s retirement will only embolden the conservatives in Congress to push harder.”

That potential scenario hasn’t rattled the market, at least not yet. Stocks rallied Friday after the Commerce Department revised its read on second-quarter GDP growth to a 3.9 percent annual pace, up from 3.7 percent — reinforcing Federal Reserve Chair Janet Yellen’s case in a speech she delivered Thursday that economic progress makes it appropriate for policymakers to raise interest rates this year and to continue boosting them gradually.

Related: Conservatives Firm on Planned Parenthood as Shutdown Looms

The Fed’s rate-setting committee is scheduled to meet again late next month and then on Dec. 15 and 16. If the committee holds off on a rate hike next month, Washington could be in the midst of another fiscal fight by the time it convenes in December, potentially clouding any rate hike decision.

Back in Feb. 2014, when Congress was also confronted with a deadline decision on the debt ceiling and Boehner’s efforts to pass a compromise plan had failed, the Speaker admitted his defeat by saying, "When you don’t have 218 votes, you have nothing.” Boehner’s successor as House speaker, whether it’s Kevin McCarthy or someone else, will be facing many of the same pressures from the right wing of his caucus — and he or she will be dealing with the same math.

So while Boehner’s resignation may reduce risks of a disruptive government shutdown and a market-rattling fiscal fight this month, it might not do much to forestall further Washington turmoil and uncertainty. And Wall Street abhors uncertainty.