What features are you willing to give up when looking for a new house in a competitive housing market? It’s a question potential homebuyers face this year amid rising prices.

While three-quarters of potential buyers think 2016 is the right time to buy a house, seven in 10 are worried that increasing home values will make it more difficult to get one, according to a new report from Berkshire Hathaway HomeServices.

Related: 14 States With the Hottest Housing Markets

To find an affordable home, buyers in the survey said they would give up swimming pools, access to public transportation, basements and proximity to work. However, they were less likely to compromise on location, floor plan, school district or curb appeal.

A majority of potential homebuyers surveyed were optimistic about the housing market, saying low interest rates made it a good time to buy. They also see modest rate hikes in the future as a sign that the market is moving in the right direction.

Last week, the interest rate on the 30-year fixed mortgage fell to an almost three-year low.

Prospective buyers are less concerned about lack of inventory than they’ve been in past surveys, reflecting an increase in available supply. The number of homes for sale reached a 6.8-month supply in January, according to CoreLogic, up from 6.5 months in 2015. A six-month supply is considered a healthy market.

Still, new home construction is lagging. Starts on single-family homes fell 9.2 percent in March to 764,000 units from February. Homebuilders, however, are still confident in the housing market, according to a sentiment index released this week.

The BHHS report comes on the same day that the National Association of Realtors reported sales of existing homes jumped 5.1 percent in March and were 4.8 percent higher in the first quarter.

Related: Here’s a Sign the Housing Market Is Returning to Normal

"Buyer demand remains sturdy in most areas this spring and the mid-priced market is doing quite well,” Lawrence Yun, NAR chief economist, said in a statement. “However, sales are softer both at the very low and very high ends of the market because of supply limitations and affordability pressures."

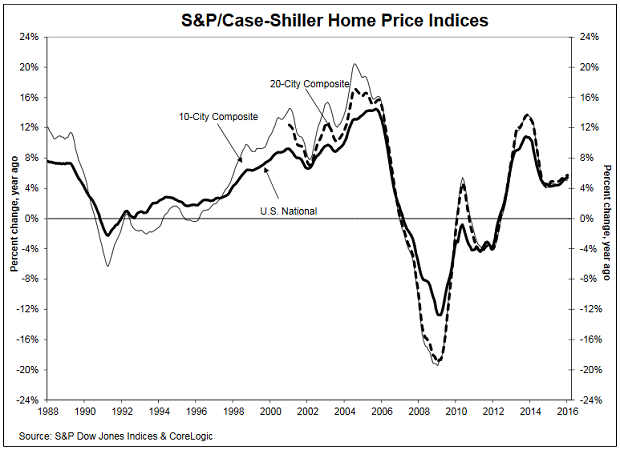

U.S. home prices increased 6.8 percent in February from the same month last year with all 50 states experiencing year-over-year increases, according to the latest figures from CoreLogic. Washington, Colorado and Florida recorded double-digit increases during the month.