Have you considered retiring in a foreign country? You’re not alone.

The number of Americans receiving Social Security benefits abroad totaled nearly 380,000 in 2014 (the latest figures available), up 49 percent from a decade earlier. The growth was fueled by a 76 percent increase in expats retiring in South America, a 125 percent gain in U.S retirees in Australia and New Zealand, and a whopping 24 percent increase in U.S. retired workers in Asia since 2004.

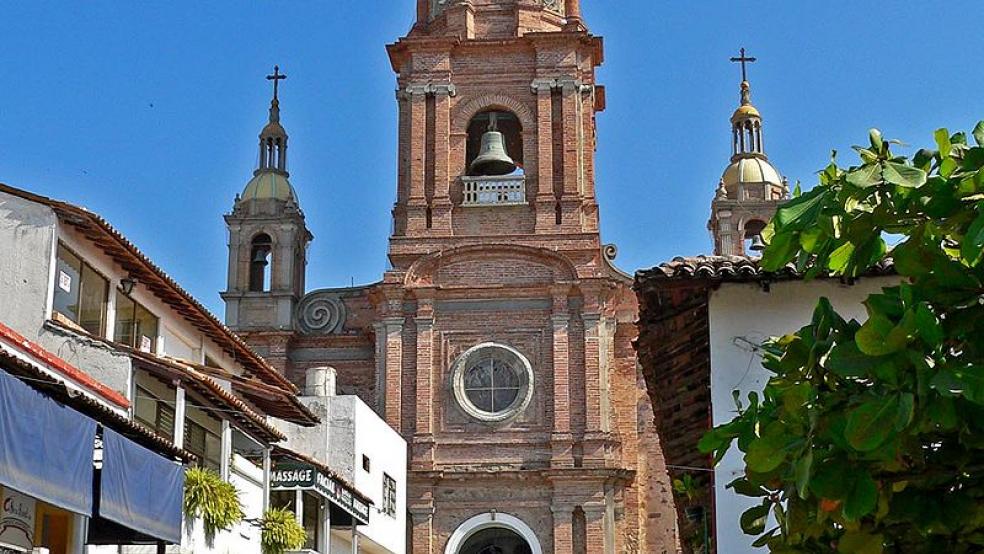

Slideshow: 12 Amazing Places to Retire Abroad in 2016

The actual number of U.S. retirees overseas may be even larger, since many people delay taking their Social Security benefits and instead rely on other income sources.

The good news is that retiring abroad is not necessarily a luxury reserved for the top 1 percent. In fact, there are plenty of countries with a cost of living that is much lower than that of the U.S., making hard-earned retirement savings go even further in the golden years.

This is not a fly-by-the-seat-of-your-pants project, though. Here are four important tips from the U.S. State Department to help you get started:

Know the residency rules: Not all immigration and residency laws are the same in every country. The State Department offers an overview on whether you need a visa to live in a certain country.

Explore any legal issues: Seek a local, English-speaking attorney who has experience dealing with ex-pats. He or she can help you determine if your estate planning documents — trust, will, power of attorney, etc. — are enforceable in the country. A lawyer can help you figure out if you need to get a local driver’s license, a work permit and what your civil rights are as a foreign resident.

Get your finances together: Consider how the exchange rate can affect any money that you withdraw from your retirement plans. Make sure you can receive your Social Security benefits overseas — check with the Social Security Administration’s Office of International Operations. Know your obligations when it comes filing and paying U.S. taxes and any tax obligations of the foreign country.

Research medical issues: Medicare doesn’t cover health care abroad, so research the cost of health insurance for medical and dental care along with medical evacuation to the U.S. in an emergency. Make sure you know the eligibility requirements of national health systems along with the quality and availability before settling down.

Click here to the best places in the world to retire.

The list was compiled by Live and Invest Overseas, a website focused on living, investing and retiring abroad.