Washington Post Columnist Catherine Rampell has a good piece up predicting a very bad development: a coming rise in tax cheating.

As Rampell notes, Americans have been pretty good about paying their taxes. While the “gross tax gap” — the difference between taxes owed and taxes paid voluntarily and on time — was estimated to be more than $450 billion a year for tax years 2008 through 2010, U.S. tax filers pay what they owe the IRS 81.7 percent of the time. IRS enforcement and late payments take that figure up to 83.7 percent.

Rampell makes the case that this relatively strong record of tax compliance is about to take a turn for the worse.

Related: Here’s Why Obama’s Medicaid Expansion Is Costing So Much More

You should read her whole argument, but the main reasons she lays out boil down to this: People will cheat more because they believe can get away with it — and because continued attacks on the IRS are bound to take this kind of toll.

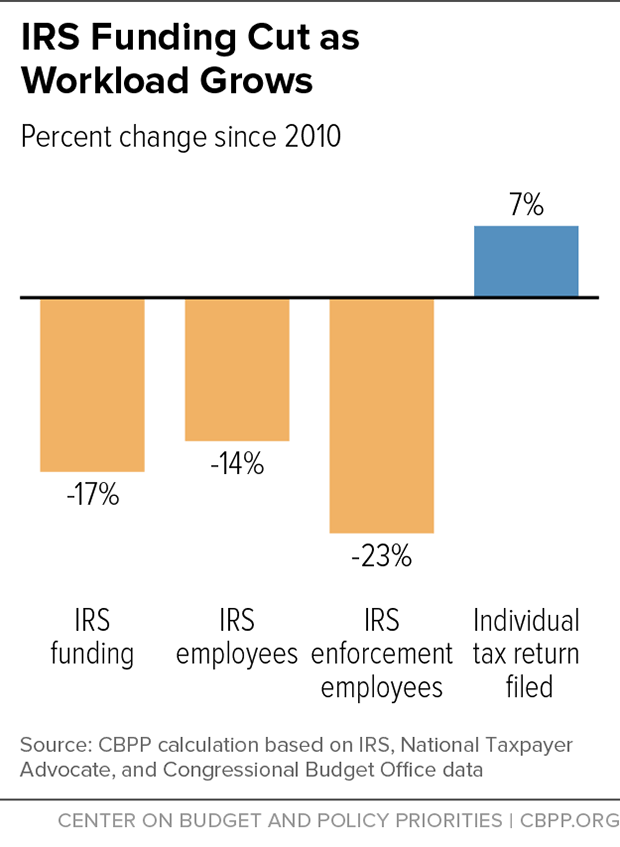

Congress has cut the IRS budget sharply since 2010, which an April report by the Center on Budget and Policy Priorities (CBPP) says has forced the agency to “reduce its workforce, severely scale back employee training, and delay much-needed upgrades to information technology systems.” Congress upped the IRS’s funding some for 2016, but the longer-term cuts have also hurt enforcement, with lower audit rates and fewer criminal tax prosecutions, all of which means more tax cheats may be able to skate by. Embattled IRS chief John Koskinen has noted that every dollar spent on enforcement yields several times as much in revenue, so that the enforcement cuts translate to losses of billions in order to achieve savings of a few hundred million. “Audits recovered about 30 percent ($30 billion) less in revenue in the past five years than in the prior five years,” the CBPP report said.

But a big part of Rampell’s prediction rests on the widespread and dovetailing ideas that the tax system as it’s currently structured is unfair and that our government and political system can’t be trusted. Koskinen, who is facing efforts by House Republicans to impeach him, gave Rampell a quote that’s troubling given the state of our political discourse: “My sense in Greece and other areas that have low compliance rates is that people look around and say, ‘Why should I be a sucker and be the only one who actually pays?’”

Related: Republican Tax Plan Would Add $191 Billion to the Debt – or Is It $2.4 Trillion?

Constant attacks on the legitimacy of the government as a whole, and the IRS in particular, combined with the real need for tax reform inevitably make more and more honest taxpayers feel like chumps.

“There’s also plenty politicians could do to prove me wrong,” Rampell writes, “by, for example, simplifying the tax code, or adequately funding IRS enforcement, or stopping actively delegitimizing the government.”

So, yeah, Rampell’s call that tax cheating will rise may be a safe one. But it’s up to you.