The average 529 account balance rose 3.1 percent in the first half of 2016 to an all-time high of nearly $21,000, according to a new report from the College Savings Plan Network.

Related: The Best College for the Money in Every State

That’s enough to cover about a year and a half of tuition and room and board at a public college for one student, after factoring in financial aid and tax benefits. It would cover about 80 percent of the first year’s costs at a private school, according to College Board data.

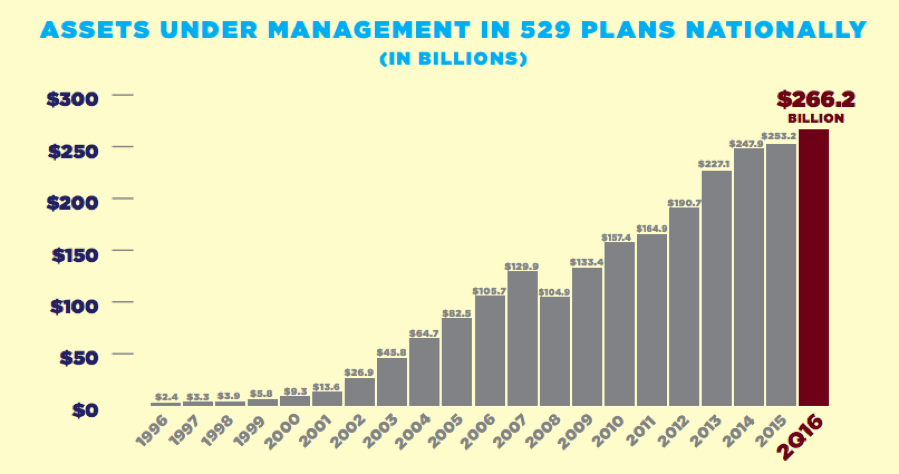

Total investment in 529 plans by Americans hit a record of $266.2 billion, with 12.7 million of the tax-favored college savings accounts now open. Since the 2008 recession, total 529 savings plan assets have more than doubled.

The college savings accounts allow families to save money for college that grows tax-free and can be withdrawn tax-free for qualified education expenses. Some states offer a tax benefit for contributions as well.

The CSPN report doesn’t break out the data by the age of the account’s beneficiary. A $21,000 balance would be a great start for families with very young children who have time for the balance to grow, but could mean a shortfall for families with teenagers.

Nearly half of families that have 529 accounts made a contribution in the first half of the year. The second half may see even more contributions, since many families make their contributions at the end of the year to meet state deadlines for tax benefits.