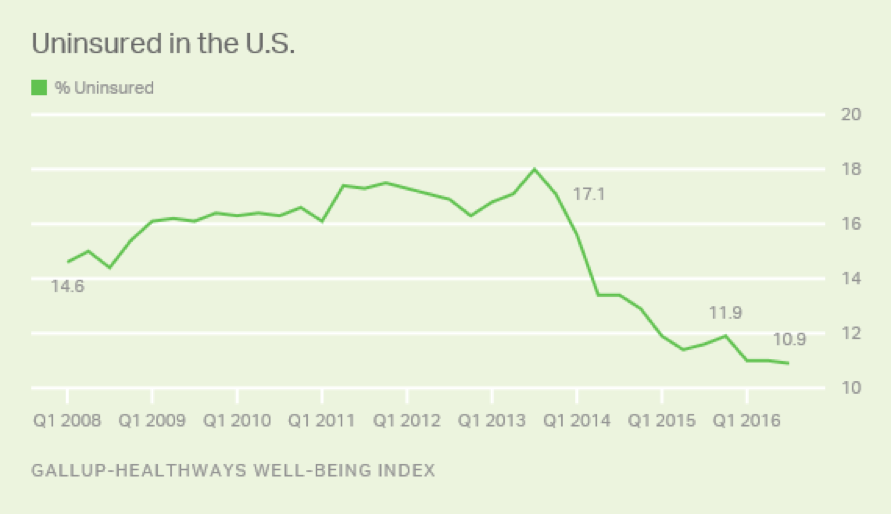

The uninsured rate for Americans has fallen to historical lows, even as the fate of the Affordable Care Act grows more perilous.

According to a new national survey by the Gallup-Healthways Wellbeing Index released on Friday, the rate of Americans going without health insurance either from their employers, the federal government or individual policies purchased on the open market dropped to a record low of 10.9 percent in the third quarter of 2016. That contrasts with 11.9 percent in the fourth quarter of 2015.

Related: Obamacare Insurers Are Looking for a Taxpayer Bailout

Since the fourth quarter of 2013 -- shortly before Obamacare’s requirement that all Americans carry health care insurance took effect -- the rate of uninsured has dropped by 6.2 percentage points, from 17.1 percent.

The latest findings come amid mounting concerns about the future of Obamacare and an emerging political consensus that major reforms are needed to make the national health insurance system economically viable in the coming years. President Obama has boasted that more than 20 million Americans have acquired health insurance coverage over the past three years, but critics warn that without a major overhaul, Obamacare will eventually collapse of its own weight.

The 2010 Obamacare legislation offers a broad range of policies and premiums to consumers of all ages and income levels, regardless of pre-existing medical conditions. The still-controversial law requires people to purchase coverage under the threat of a penalty – a mandate that many Republicans have strongly opposed. The ACA also provides subsidies to millions of low-income Americans who purchase coverage on government-run exchanges. And it attempts to protect insurers from major financial losses on the exchanges in the early years of the program.

Congressional Republicans for years have pressed to repeal and replace Obamacare with a more market-oriented system, a position embraced by Republican presidential nominee Donald Trump. While Democratic presidential nominee Hillary Clinton has been a strong defender of the law, she too has proposed changes, including a movement towards a “Medicare for all” approach that would greatly expand coverage and lower premiums and out-of-pocket costs.

Related: Obamacare’s Death Spiral of Consumer Choice

Former president Bill Clinton recently described Obamacare as a “crazy system” in which premiums doubled and recipients had their coverage cut in half – a candid assessment he was forced to recant after Republicans pounced on it to try to embarrass his wife.

The Obamacare program now faces a major challenge as it approaches the fourth annual enrollment season beginning Nov. 1, just a week before the election. Consumers in many states will be hit with much higher premiums and out-of-pocket costs, while a number of major insurers – including Aetna, Blue Cross-Blue Shield, UnitedHealth and Humana—have announced they are sharply curtailing participation because of huge financial losses in the past couple of years.

Moreover, only five of the original 23 experimental non-profit co-ops created under Obamacare will continue to provide coverage across the country. Just this year, five of these co-ops closed their doors or announced they were going out of business. Earlier this week, Evergreen Health, another co-op operating in Maryland, announced it would convert to a for-profit company to avoid the possibility of having to shut down as well.

“There’s no question that the massive infusion of cash into the insurance system and the gigantic subsidies that many people got have been highly successful in reducing the uninsured rate,” Joseph Antos, a health care expert with the American Enterprise Institute, said today in discussing the new Gallup findings. “But it is true that the government exchange business hasn’t been good for most insurers and the co-ops have largely collapsed.”

Related: UnitedHealth Makes Good on Threat to Pull Out of Obamacare

“The pull-outs by UnitedHealth, Aetna and others really tells you that the folks who are saying that we have succeeded here [in reducing the rate of uninsured] shouldn’t rest on their laurels,” he added. “Clearly this is a sign that things need to be changed. I think that is now recognized out of the White House and maybe inside the White House a little bit.”

The Gallup survey of 44,000 people 18 and older was conducted between July 1 and Sept. 30. Among its key findings:

- The largest improvement was among low-income households and Hispanics. Thirty percent of low-income Americans were uninsured in the fourth quarter of 2013, in contrast with 20 percent in the third quarter of 2016. While nearly 39 percent of Hispanics were uninsured during the last quarter of 2013, just 27 percent were uninsured in the third quarter of 2016. Nonetheless, “these groups remain the ones with the highest uninsured rates,” according to the report.

- African-American adults have also benefitted from expanded coverage. The rate of uninsured among blacks plummeted from 20.9 percent in 2013 to 11.6 percent in 2016.

- Since late 2013, the largest overall change has been among people who purchased health insurance plans for themselves and their families on the government’s subsidized insurance exchanges or individual plans they purchased directly from an insurer. Some 21.5 percent of these purchases were made during the third quarter of 2016, compared with just 17.6 in the fourth quarter of 2013.

- The decision by many states to expand Medicaid coverage has played a crucial role in reducing the rate of uninsured Americans. The share of adults covered by Medicaid rose from 6.9 percent in the fourth quarter of 2013 to 9.4 percent in the third quarter of 2016.

The survey findings suggest that the sharp declines in the uninsured rates in the first year of Obamacare – when the government opened insurance exchanges and uninsured people were mandated to acquire coverage – have leveled off. “The declines remained mostly steady in the second and third years after the individual mandate went into effect, from 11.9 percent in the fourth quarter of 2015 to 10.9 percent in the third quarter of 2016,” Gallup reported. “These changes in the second and third years after the individual mandate went into effect are not surprising since the remaining uninsured are likely among the hard-to reach population or those most resistant to complying with the law.”