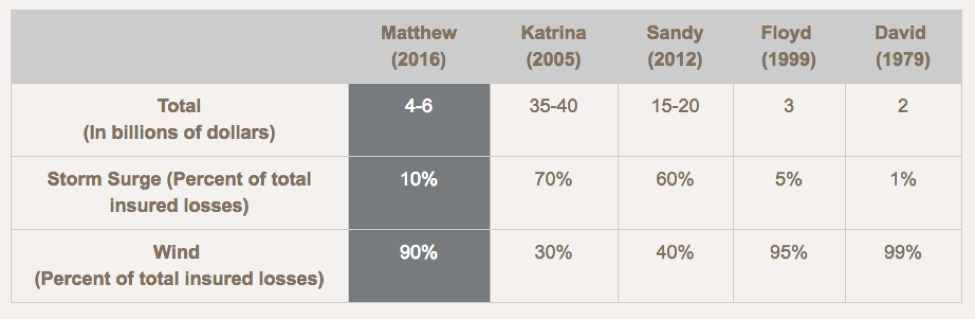

While the impact of Hurricane Matthew on the U.S. ended up being less severe than meteorologists had anticipated, the storm still caused up to $6 billion worth of damages.

About 90 percent of those claims are due to wind damage, while 10 percent are related to the storm surge, according to a new estimate from CoreLogic. The cost estimate does not account for the cost of additional flooding, business interruption or damages to property contents. The total cost of the storm will be much higher.

Source: Insured Property Loss Estimates, CoreLogic

While that’s a significant amount, it’s far below the level of insured losses from Hurricane Katrnia ($35 billion to $40 billion) or Sandy ($15 billion to $20 billion). New construction practices in Florida helped minimize the damages there.

CoreLogic estimates that the storm caused insured losses to 1.5 million homes and businesses.

Related: After Hurricane Matthew, Five Ways to Deal with Damage

A separate June report from CoreLogic found that more than 6.8 million U.S. homes, worth more than $1.5 trillion, are at risk of being hit by a storm surge. The state with the largest share of vulnerable homes is Florida (2.7 million), followed by Louisiana (800,000) and Texas (531,000).

Florida also tops the list of states with the highest potential reconstruction costs due to storm surges, with $536 billion worth of homes as risk. Florida was hit by seven of the 10 costliest hurricanes ever to hit America, according to the Insurance Information Institute.