Average published tuition and fees for full-time students for 2016-2017 is continuing to go up, but undergraduate students are relying less on loans to cover those costs, according to a new report from the College Board.

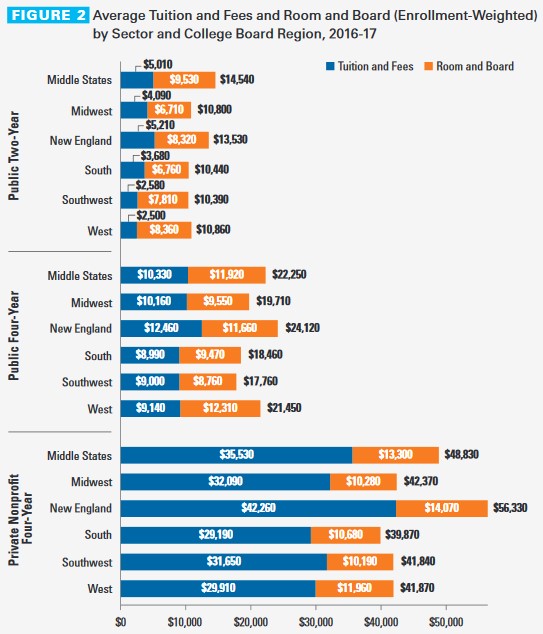

The average published tuition and fees for those attending in-state four-year college this year increased 2.4 percent before inflation to $9,650. The rates for out-of-state students went up 3.6 percent to $24,930; and the rates for private college went up 3.6 percent to $33,480.

Related: 15 States With the Most Student Debt

While those increases are lower than last year’s and smaller than the average increases over the past decade, they still outpace the growth in family incomes and overall inflation.

Source: The College Board

To cover those costs, students are borrowing less and relying more on federal grants. Loans covered just 36 percent of college costs last year, the lowest level in at least 20 years, and grants hit their highest level in the same period.

Despite the increase in grants, the net price paid by students (the amount of tuition minus grants) is still going up. The average net price paid at public four-year schools is $3,770 for 2016-2017, 40 percent higher than in 2009-2010. For private four-year schools, the average net price is $14,190.

“These increases, combined with stagnant incomes for many families, raise concerns about ensuring educational opportunities for low- and moderate-income students,” College Board policy research scientist Jennifer May said in a statement.