Stock futures plunged and bonds rallied as the outcome of the presidential election remained much tighter than expected.

Investors moved into bonds and stocks cratered as traders questioned whether Democrat Hillary Clinton could win the race, as expected. The Mexican peso fell sharply against the U.S. dollar.

"I would say the market is a bit more cautious as it doesn't seem to be such a quick and decisive victory for Hillary as it seemed," said Ian Lyngen, head of U.S. rate strategy at BMO. "But it's not over yet."

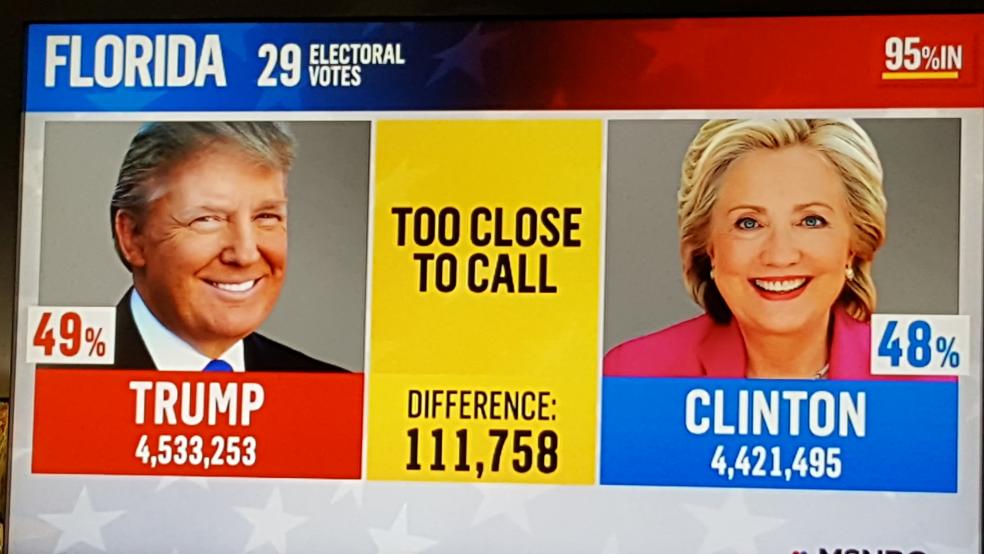

Traders watched for an outcome from Florida, a state that is still considered too close to call by NBC. Florida's battle has been tense and was separated by only a single percentage point with 91 percent of the vote in, according to NBC.

"Trump needs to win Florida, but he also needs to win Pennsylvania, North Carolina and New Hampshire. Even if he wins Florida he still has a big hurdle in front of him," said Dan Clifton, head of policy research at Strategas. "Florida's close, so the question how does he do in … those other states. It's early."

Traders were hoping to get an early read from Florida but the tightness there raises questions about other states.

"Virginia being close was kind of sentiment shift for futures. But it's really Florida everyone is focused on right now," said Brian Kelly of Brian Kelly Capital. "The knee-jerk reaction is lower because of his protectionist policies and what his foreign policies mean for countries doing business in the rest of world."

NBC News projected Republicans retain control of the House of Representatives. Wall Street has favored a win by Clinton but Republican control of congress. It was still too early to tell whether Republicans would win a majority in the Senate.

U.S. futures have been volatile, with Dow futures up as much as 100 points at one point, and later down 200 points. In Asia, the Nikkei was down more than 1 percent, erasing a more than 1 percent gain on the day. The S&P 500 ended Tuesday's session higher, up 8 at 2,139, as markets speculated that Clinton was in the lead.

The Mexican peso, which has been a proxy for Trump, was down as much as 5 percent against the dollar. Trump has said he would build a wall along Mexico's northern border and break trade deals with the country. The U.S. dollar also gave up early gains against the yen and Swiss franc.

Dominic Schnider, head of Asia Pacific Currency and Commodities at UBS Wealth Management in Hong Kong, said the markets were in a wait and see mode.

"I think a lot of people here are looking into gold. That's one thing people have been looking into with the polls shifting toward Hillary," said Schnider. Gold futures were higher in the Asian session after earlier moving lower in New York trading.

"We have seen activity by Asian clients in Latin American currencies. That's very unusual," he said, noting there's been a lot of put selling in Mexican peso. "They probably think the bias is toward Clinton."