There are lots of reasons to celebrate during the holidays, but for many Americans, sticking to a budget isn’t one of them.

More than half of Americans surveyed by Experian said they spend too much during the holidays, and 55 percent said the season causes them stress over their finances.

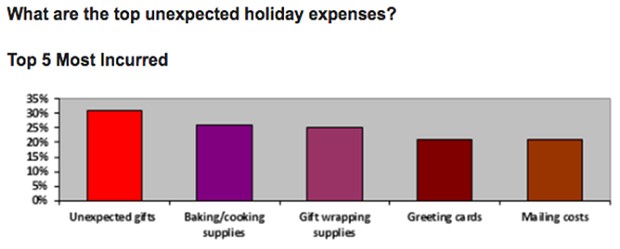

One of the key drivers of over-spending is unexpected expenses, which add up to an average of $288 per person.

Source: Experian

Additional gifts were the most common unexpected expense, incurred by nearly a third of consumers, followed by baking supplies, gift-wrapping supplies and greeting cards. Nearly one in three people surveyed said they used their credit cards to cover unexpected holiday expenses.

Related: The Early Bird’s Guide to Holiday Shopping: 7 Stress-Reducing Tips

“What consumers don’t realize is that after the merriment of the holidays, they won’t be having such a happy New Year because they will be saddled with debt,” Experian director of public education Rod Griffin said in a statement. “With a little bit of planning, consumers can save themselves a lot of stress and put themselves in a better financial position in 2017.”

The survey found that 44 percent of consumers feel obligated to spend more than they can afford when buying gifts, and 43 percent of those who are stressed during the holidays say it’s because they don’t have extra money to buy presents.

This year, the typical shopper plans to spend more than $1,100, according to PwC. That’s a 10 percent increase over last year and the highest level since the Great Recession.