President-elect Donald Trump appeared in the lobby of Trump Tower on Tuesday and made an unexpected announcement. Standing beside Masayoshi Son, the founder and CEO of the Japanese telecommunications conglomerate Softbank, he said Son was planning a $50 billion investment in the United States as a direct result of Trump’s election victory last month.

The news raised more than a few questions about what was actually going on, coming as it did just hours after Trump used his Twitter account to threaten to cancel an as-yet non-existent contract with airplane manufacturer Boeing to build the next generation of the presidential airliner, Air Force One. The cause of Trump’s attack on Boeing remains unclear, as does the basis for his assertion that the company was doing “a number” on the U.S. by charging $4 billion for the two airplanes.

Related: Like LBJ, Trump Is Loving the Role of America’s Dealmaker

As Boeing share price tumbled in the confusion, Trump held an impromptu meeting with the press, after accompanying Son into the lobby of Trump Tower. Describing him as a “great man of industry,” Trump declared that Son’s $50 billion investment would generate 50,000 jobs in the U.S. And on Twitter, he claimed, “Masa said he would never do this had we (Trump) not won the election!”

For his part, Son told the press, “I just came to celebrate his new job...Because he said he would do a lot of deregulation, I said, ‘This is great, the U.S. will become great again’.”

Who is Masayoshi Son?

Son is the founder of Softbank, a Japan-based firm that has invested aggressively around the world, primarily in telecommunications companies. It holds an 83 percent stake in U.S. wireless carrier Sprint, and tried, a few years ago, to acquire T-Mobile, before seeing the deal scotched by regulators over antitrust concerns.

Where is the money coming from?

This is a question that at first puzzled many people who heard the announcement. Softbank is a major company, but with a market capitalization of $67 billion and debts of more than $100 billion, how it was planning to come up with $50 billion to invest in the U.S. was unclear.

Related: Trump Blows the Whistle on Boeing’s $3.2 Billion Air Force One Contract

It turns out that the money is expected to come from a technology-focused investment fund that Softbank is creating with partners, the most notable of which is the government of Saudi Arabia’s sovereign wealth fund.

It’s remarkable, to say the least, that Trump is not just celebrating, but is taking credit for a major infusion of Saudi cash into the U.S. economy. During the presidential campaign, he pilloried Democratic candidate Hillary Clinton over the fact that the Clinton family foundation accepted money from the Saudi for charitable works.

“Crooked Hillary says we must call on Saudi Arabia and other countries to stop funding hate,” Trump wrote Facebook in June. “I am calling on her to immediately to return the $25 million plus she got from them for the Clinton Foundation!”

“Saudi Arabia and many of the countries that gave vast amounts of money to the Clinton Foundation want women as slaves and to kill gays,” Trump wrote in a separate post. “Hillary must return all money from such countries!”

Related: As Trump Gets Tough With China, Facebook Plays Their Game

Did Trump’s election really drive the decision to invest?

There’s no way of knowing for certain, but there are ample reasons to doubt that Softbank, the Saudis, and other partners in the investment fund were holding their breath and waiting for the election results before deciding to invest in the U.S.

The fund, which is supposed to grow to $100 million, had been in the works well before the election and was made public at a time when Trump’s victory looked extremely unlikely. Also, the express intention of the fund’s creators was to invest in innovative technologies. Given that the U.S. in general, and Silicon Valley in particular, is the epicenter of tech innovation, a large share of the money was likely always headed for the states.

Where will the money be invested?

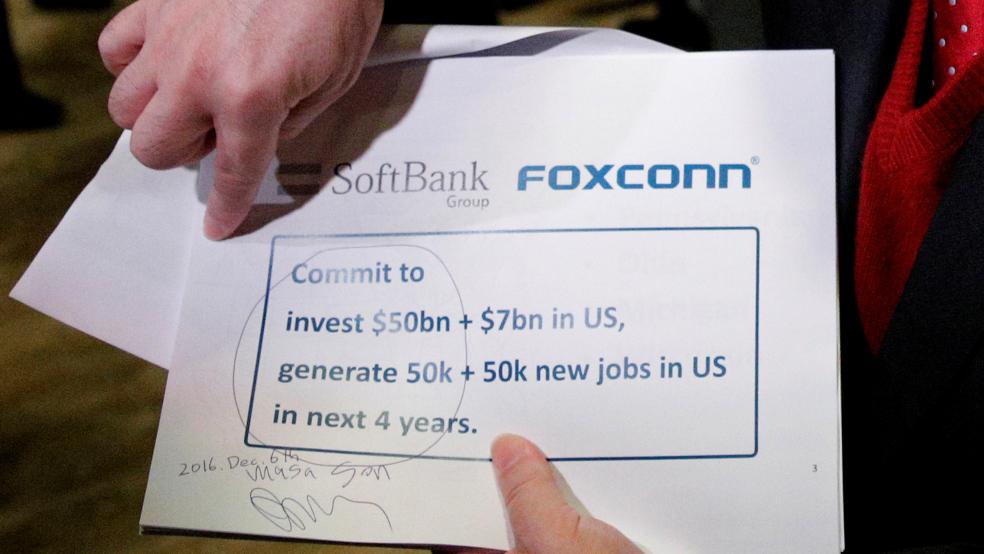

At this point, nobody knows -- maybe not even the investors themselves. One possible clue, though, was a piece of paper that Son held up when he and Trump met with the press. On it, one could make out the logo of Foxconn Technology Group which, among other things, assembles electronic equipment like Apple’s iPhone.

Related: Here’s the Problem With Trump’s Plan to Sell Health Insurance Across State Lines

Foxconn on Tuesday issued a statement saying “we are in preliminary discussions regarding a potential investment that would represent an expansion of our current US operations.”

How big a deal is this, anyway?

While new, well-paid jobs are always a welcome addition to the U.S. economy, some perspective is probably in order. The U.S. has been adding an average 178,000 jobs per month in 2016. Assuming that the Softbank/Saudi investment fund follows through on its $50 billion/50,000 jobs promise, it would likely take several years to take full effect, meaning that the increase in jobs would feel less like a surge than a slight increase spread over a long period of time.