Yet another study finds that many student loan borrowers are struggling to make their payments. This study, however, isn’t focused on young college grads, who have decades of earning years ahead of them. Instead, it looks at a more surprising cohort: 60-somethings who are at or near retirement.

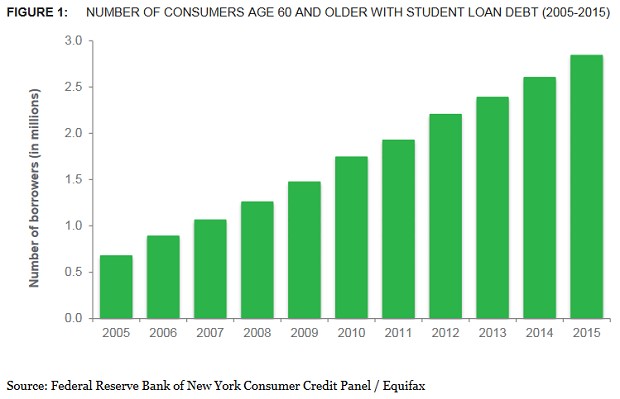

The report from the Consumer Financial Protection Bureau says the number of borrowers over age 60 has quadrupled in the past decade, and the amount that they owe has doubled to nearly $24,000. Four in 10 borrowers over age 65 were in default.

Related: 5 Tips to Pay Off Your Student Loans the Smart Way

“Many of these older Americans are helping finance their children’s or grandchildren’s education while living on a fixed income,” CFPB Director Richard Cordray said in a statement. “We are concerned that student loans are contributing to financial insecurity for many older Americans and that student loan servicing problems are contributing to their distress.”

Three-quarters of older student loan borrowers took on the debt in order to help their children or grandchildren pay for college. Managing those loans is harder for older adults who may have already passed their peak earning years and may have other debt such as mortgages. The CFPB found that they’re more likely than those without student debt to skip health care expenses because they can’t afford them.

The report also exposed some shady practice among loan servicers that are making the problem worse. Among them, services are making it difficult for older borrowers to enroll in income-driven repayment programs; they’re incorrectly applying co-signer payments to other loans owed by a primary borrowers; and they’re failing to provide access to loan information.