Valentine’s Day is a chance for some to celebrate their love, but this time of year is also among the most likely for couples to file for divorce. That may be because couples that were able to hold it together through the holidays are finally realizing they they’re not going to be able to make it work long term.

For many of those couple, money may be a driving force behind the split. More than one in five divorced people surveyed by Magnify Money cited financial issues as the cause for their divorce. The percentage was higher for higher earners (33 percent) and younger couples (24 percent).

Related: 6 Money Mistakes to Avoid When You’re Getting a Divorce

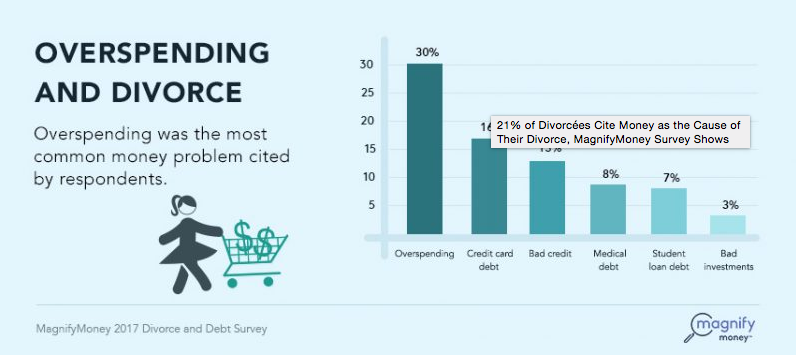

Among those who cited money as the cause of their divorce, 30 percent said that overspending was the biggest source of tension, followed by credit card debt and bad credit. More than half of couples with money issues reported that they or their spouse lied about money or hid financial information from their partner.

Often, divorce itself creates its own set of financial issues. Nearly six in 10 of those who cited money as the cause for their marriage ending said that they went into debt because of the split, with 23 percent saying they owed more than $20,000 in debt following their divorce.

Most experts recommend meeting with a financial planner before your divorce for advice about splitting up assets and to help rejigger your long-term financial plan to reflect your new status as a single person.