There’s a flipside to everything, and that goes for the very good news about the US economy embodied in Friday’s strong jobs report issued by the Department of Labor. The addition of 235,000 jobs to the economy, rising wages, falling unemployment and the return of workers to the labor force are unquestionably positive developments in that they signal strengthening economic growth. But they are bad news for the federal deficit and debt.

That’s because the signs of a strengthening economy from the jobs report make it much more likely that the Federal Reserve’s policy makers on the Federal Open Market Committee will vote later this month to raise interest rates, and that they may well do so two times more before 2017 is over.

Related: Medicare Could Save Nearly $16 Billion a Year Negotiating Drug Prices

In and of itself, that isn’t a bad thing. Rates are still sitting near historic lows, and raising them isn’t likely to have major negative effects on the economy. However, it does mean that as rates rise and the federal government keeps borrowing money to finance deficit spending and to roll over existing debt, both at increasingly higher rates of interest, the amount of money the country spends on debt service will take up a larger and larger share of the federal budget.

“This is one reason that we can’t really count on economic growth to fix all our problems because it has offsetting effects,” said Marc Goldwein, a senior vice president with the Committee for a Responsible Federal Budget. “Faster growth is always better than slower growth, but it’s not a pure win for the federal budget. There are offsetting effects in the form of higher interest payments and larger Social Security benefits.”

To be sure, this doesn’t have to be so. If Congress were willing to find a way to increase federal revenues, the percentage of the national outlay on debt service as a share of the budget could be kept steady. Likewise, if Congress were willing to spend less in order to reduce or eliminate the deficit, the Treasury wouldn’t need to add to the debt burden.

But judging from the proposals emanating from both the Trump White House (Trillion dollar infrastructure spending! Massive defense buildup!) and from Congress (Big tax cuts for the wealthy! Bigger tax cuts for business!) federal revenues are headed down, not up, and both the deficit and the debt are likely to increase.

Related: Trump Uses His ‘Discredit Tactic’ on CBO to Hedge Against Negative Report

That means that for every dollar in taxes Americans send to the Treasury in April, a little more is going to go to debt service, and less is going to go to the services delivered by the federal government. In Fiscal 2016, according to the Treasury Department, the federal government paid $433 billion in interest on its outstanding debt of nearly $20 trillion.

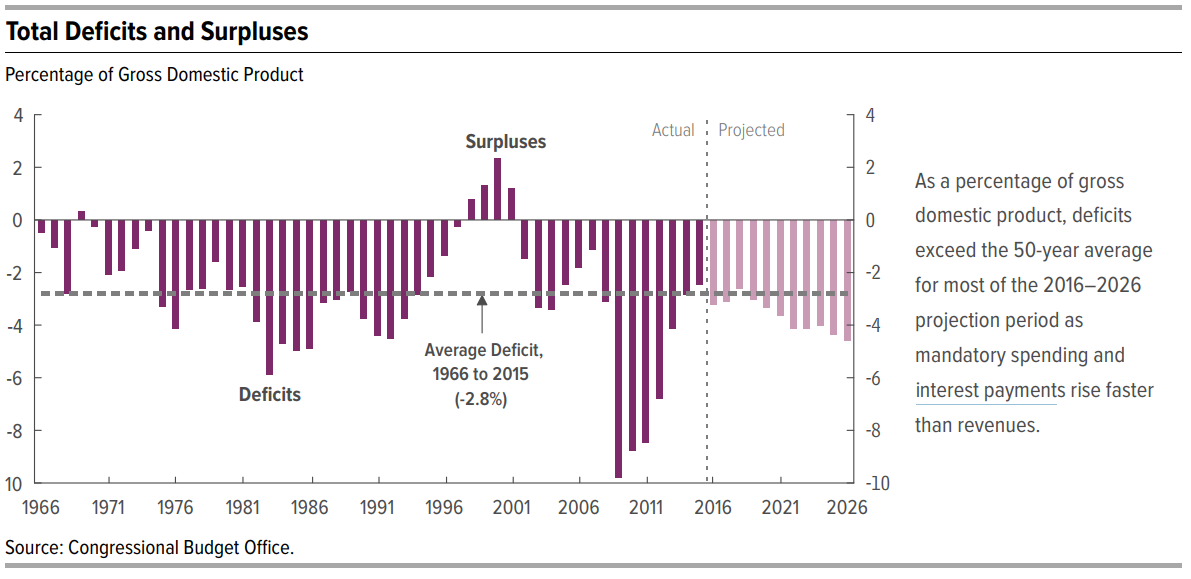

The Congressional Budget Office says rising interest rates have a clear and dramatic effect on the Treasury Department’s interest payments. In the first five months of Fiscal 2017, the government had already spent $188 billion on interest payments.

In an analysis last year, the Capitol Hill budget watchdog agency wrote:

If interest rates on all types of Treasury securities were 1 percentage point higher each year through 2026 than is projected in the baseline and all other economic variables were unchanged, the government’s interest costs would be substantially larger. The difference would amount to only $16 billion in 2016 because most marketable government debt is in the form of securities that have maturities greater than one year. As the Treasury replaced maturing securities, however, the budgetary effects of higher interest rates would mount. Added costs from higher interest rates on the debt projected in CBO’s baseline would reach $200 billion in 2026 under this scenario.

The cumulative impact is even more dramatic, CBO notes. “In sum, if interest rates were 1 percentage point higher than projected in CBO’s baseline, the deficit would worsen progressively over the projection period by amounts increasing from $38 billion in 2016 to $260 billion in 2026. The cumulative deficit would be $1.6 trillion higher over the 2017–2026 period.”

Related: Will CBO Deal a Death Blow to the GOP Health Care Plan?

Goldwein of CRFB explains, “The interest feedback is going to be so large is because the debt is so large. If your debt is low, a one percent increase doesn’t have a big effect. But when your debt is high, the effect can be large.”

To protect against interest rate risk, he said, the best thing the country could do would be to reduce the national debt, if not on an absolute basis, then at least as a share of Gross Domestic Product.