If nothing changes, by the time today’s 50-year old reaches retirement age, Social Security will be paying 21 percent less in benefits than it is today.

Yet, while there is little doubt that Social Security is on track for a financial meltdown in the coming decades, the Trump administration and Republican Congress have so far done what so many have done before them -- put the festering problem on the legislative back burner.

With their hands full trying to resurrect their troubled Obamacare replacement legislation and the possibility that even tax reform and infrastructure financing may be out of reach before the end of the year, concerns about Social Security will likely wait until at least after the 2018 mid-term elections.

Related: Here’s a First Draft of the GOP’s Plan to Overhaul Social Security

Yet that hasn’t prevented concerned lawmakers and advocacy groups from both parties from exploring solutions to the long-term challenge. And while few issues are as politically explosive and contentious, there may be a thaw in the long-running battle over how to preserve the nation’s main retirement program.

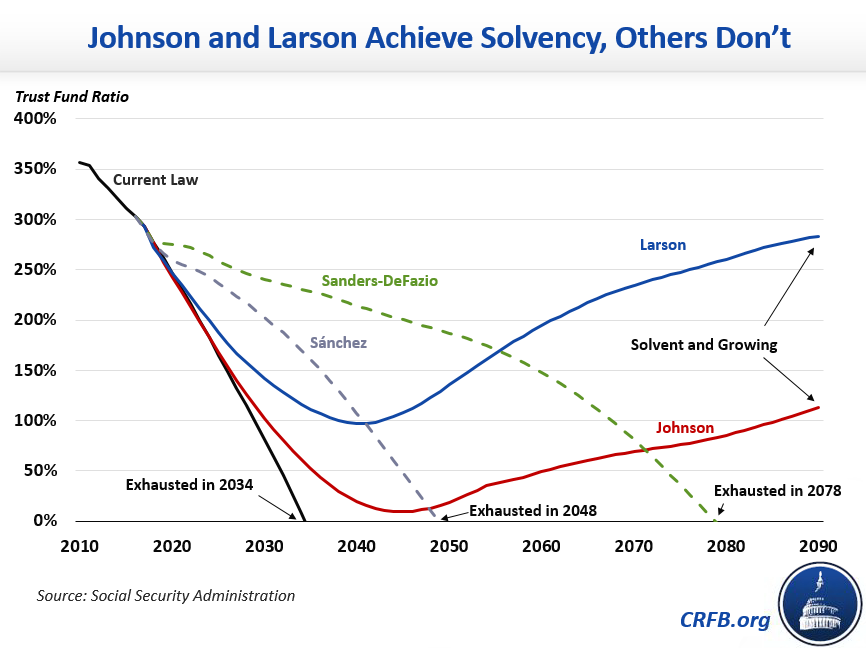

Remarkably, one of the most conservative Republicans and most liberal Democrats in the House appear to be singing from the same hymnal in one important way: Both have now introduced plans that – if enacted by Congress and signed by the president -- would make the program solvent for the next 75 years and beyond.

“Social Security’s long-term imbalance represents one of our most serious fiscal challenges and one that most lawmakers are all too willing to ignore,” the Committee for a Responsible Federal Budget, a prominent anti-deficit research group, wrote in a new analysis.

The two lawmakers – Reps. Sam Johnson of Texas and John B. Larson of Connecticut—are the senior Republican and Democrat on the Ways and Means subcommittee on Social Security. Johnson, the subcommittee chair, caused a minor uproar last December when he sought to spark a “fact-based” conversation by circulating a bill to reform Social Security by making major cuts and changes to the system in the coming decade. Larson this month introduced the “Social Security 2100 Act” designed to cut taxes for Social Security recipients and provide a substantial bump in current and future benefits.

While the two men “show two very different ways of fixing Social Security,” according to a CRFB analysis, “they share key areas of agreement that could show the foundations of an eventual bipartisan compromise.”

Related: Trump’s Tax Plan Could Affect Your Social Security

The Social Security trust fund -- which spends about $918 billion a year in benefits to retirees and their families as well as disabled workers – is not in any imminent danger. Some liberal activists complain that conservatives are attempting to manufacture a crisis and that the trust fund will be in good shape for years to come.

However, the Trustees Report in March 2016 warned that the fund will begin running out of money in 2034. At that time, beneficiaries will begin to face a 21 percent benefit cut in retirement and disability coverage.

At first blush, Johnson’s plan appeared to be little more than a frontal attack on Democrats and senior citizen advocates: The veteran Texas politician’s measures included gradually raising the retirement age for receiving full benefits from 67 to 69 and adopting a less generous cost of living index than the current one. Those were fighting words for seniors’ groups and Democrats.

“Slashing Social Security and ending Medicare are absolutely not what the American people voted for in November,” House Minority Leader Nancy Pelosi (D-CA), said in a statement. “Democrats will not stand by while Republicans dismantle the promise of a healthy and dignified retirement for working people in America.”

Related: A New Plan to Save Social Security for Another 75 Years

But Johnson also provided some sweeteners for Democrats: One would increase retirement benefits for lower-income workers and another would increase the minimum benefit for low-income earners who worked full careers. Sen. Bernie Sanders (I-VT) campaigned for president in 2016 calling for increased Social Security benefits, especially for widows and others struggling to make ends meet, by raising the cap on the federal payroll tax that goes to fund Social Security.

Some Democrats may have also liked Johnson’s proposal to inaugurate means testing by changing the benefits formula to reduce payments to wealthier retirees. It would also eliminate the annual COLA adjustments for wealthier individuals and their families.

Most importantly, Johnson’s plan would extend the life of the Social Security trust funds for decades to come – a move designed to alleviate the concerns and anxieties of the 61 million Americans who receive old age survivor’s and disability insurance benefits. Johnson’s bill would extend the life of the trust fund for another 75 years – a move that was applauded by both parties and that spurred others to suggest alternative approaches.

That’s where Larson’s bill comes in. The Connecticut Democrat’s plan is far different from Johnson’s approach in many ways. For instance, it would provide tax cuts for over 10 million lower-income Social Security recipients by raising the $127,200 threshold on the payroll tax used to finance the program to force wealthier people to pay more for their benefits.

Larson would tax earnings above an unindexed $400,000 by gradually raising the payroll tax from 12.4 percent to 14.8 percent on all workers.

Related: Think Trump Will Make Your Taxes Easier Next Year? Don’t Get Your Hopes Up

His plan would also begin raising benefits in 2018 for current and new beneficiaries along the lines demanded by progressives in his party. And it would protect low-income workers by raising the minimum benefit from below the federal poverty line to 25 percent above it. By contrast, Johnson would enhance solvency primarily by slowing the growth of benefits for wealthier Americans and raising the retirement age for all workers from 65 to 67, as CRFB noted.

The bottom line: both Larson’s and Johnson’s plans not only would prevent the Social Security trust fund from going belly up beginning in 2034 with the attendant cuts in benefits but would also make the program solvent for the foreseeable future.

The Social Security Office of the Chief Actuary evaluated each of the plans and concluded that both would meet the actuaries’ standard of sustainable solvency. That would make Social Security solvent for the next 75 years and leave the program with a growing trust fund at the end of the valuation period.”

By 2090, the trust funds would run a small surplus under Johnson’s approach and show a very small deficit under Larson’s bill. CRFB concluded that that would be “hugely important” because it would demonstrate that the trust funds not only were actuarily sound but also financially sound.

Here’s how the two proposals stack up against other plans to preserve Social Security.