Three-quarters of graduating college students will have student loans to deal with, and most are optimistic about paying off those loans quickly.

Among those who have student loans, nearly half expect to be done with student loan payments in less than five years, and another 28 percent expect to have paid off their loans within 10 years, according to a new study from McGraw-Hill Education.

Related: The 15 Most Expensive Colleges in America

However, while the standard student loan repayment plan for federal loans lasts 10 years, many students end up making payments over a longer time period because they refinance their loans or enter an income-based repayment program that lets them spread their payments over a longer period of time. Others end up adding to their loan balance when they borrow additional funds for graduate school.

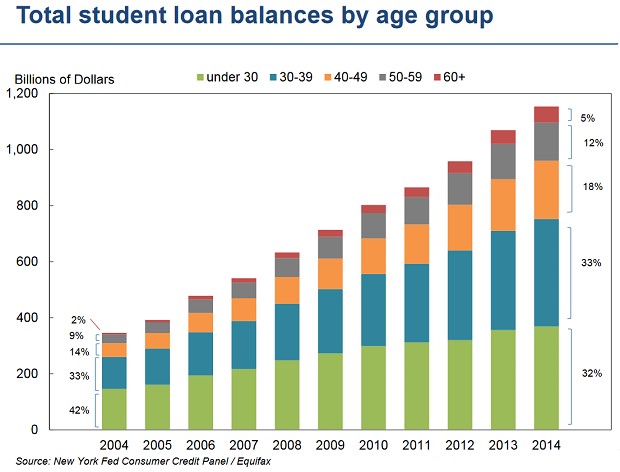

A third of the $1.2 trillion in outstanding student loans is held by people in their 30s, and another 18 percent is owed by people in their 40s, according to a 2015 analysis by the New York Fed.

It’s unlikely that today’s graduates will be able to pay down their loans more quickly. The average debt load at graduation is now more than $30,000. A 2013 report found that the average repayment period for student loans was more than 20 years.

Still, there are some financial reasons that it makes sense for young adults to put off paying down their student loans. Most financial planners agree that it’s more important to build up an emergency fund than to make extra payments on student loans, and to make sure that you’re also saving for retirement, especially if you have access to an employer match.