The Senate’s attempt to replace the Affordable Care Act looks more imperiled by the hour, with key Republicans suggesting that they won’t even support a procedural vote meant to bring the Better Care Reconciliation Act to the floor for debate. The reason the Senate appears to be on the verge of failure in its long quest to overturn Obamacare is, not to put too fine a point on it, that most people think the BCRA is a bad piece of legislation.

That sentiment crosses party lines and even subdivisions within the Republican Party itself. Not everyone shares the same reason for their dim view of the bill, which was negotiated in secret and only released last Thursday. Some believe it doesn’t go far enough in rolling back the ACA. Others fear it goes too far, citing Congressional Budget Office projections that it will leave 22 million fewer Americans with coverage after 10 years.

Related: Senate Proposes Harsh Penalty for Going Without Insurance

Here are five reasons why the BCRA has a hard time finding broad support, even in a Republican-dominated Senate.

You’ll Pay More, but Get Less: One of the most frequently stated goals of Republicans in discussing ACA repeal was the desire to lower insurance premiums for Americans buying their coverage on the individual market. If it were put in place, the BCRA wouldn’t even achieve that for the first several years. However, in the third year of implementation, premiums would start to decline.

The reason for that, though, isn’t an argument in favor of the bill. Premiums would decline because policies would offer less protection from financial hardship, and customers would have to face much higher deductibles.

Fewer Americans Will Have Coverage: This problem is a corollary to the first. The bill would result in 15 million fewer Americans with insurance after just one year, and that number would grow to 22 million over a decade, CBO claims.

Related: The Obvious Problem With the ‘Simple’ GOP Solution for Health Care

Republican supporters of the bill, like House Speaker Paul Ryan, have tried to spin this finding as a positive good. The idea is that millions of people who were only purchasing insurance because the ACA forced them to will no longer be subject to tax penalties if they opt out.

But CBO says the real story is more complicated. “Under this legislation, starting in 2020, the premium for a silver plan would typically be a relatively high percentage of income for low-income people. The deductible for a plan with an actuarial value of 58 percent would be a significantly higher percentage of income—also making such a plan unattractive but for a different reason. As a result, despite being eligible for premium tax credits, few low-income people would purchase any plan.”

It Breaks Medicaid Promises

When President Trump was campaigning, he promised that there would be no cuts to Medicaid under his presidency. The Senate bill would slash more than $800 billion from projected Medicaid spending over a decade.

The bill’s supporters are desperately spinning the reduced Medicaid funding as something other than a cut. They’re doing so largely on the claim that because annual spending will still increase, it’s not fair to say that reducing expected spending by hundreds of billions of dollars is an actual “cut.”

Under the bill, people living with virtually no income could find their only option for health insurance coverage to be a bare bones policy sold on the exchanges, where premiums are almost completely subsidized, but out-of-pocket deductible payments run to $6,000 per year.

Related: Rough Seas Ahead for Senate Passage of the GOP Health Care Bill

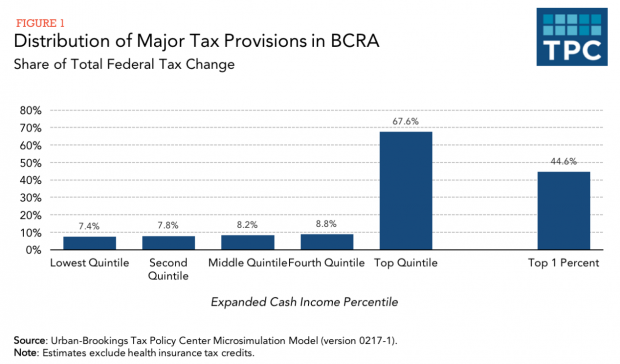

It Disproportionately Benefits the Rich: A key element of the bill is the repeal of virtually all of the taxes imposed under the Affordable Care Act, most of which were directed at high-earning Americans. Among them: a surcharge on investment income for people with yearly earnings above a certain threshold, a tax on medical devices, and a 0.9 percent payroll tax on high earners.

More than two-thirds of the cuts will benefit the top 20 percent of earners in the US, and about two-thirds of that will go to the very wealthiest one percent.

Writing at the Tax Policy Center’s TaxVox Blog, Howard Gleckman noted, “The effects of the Senate leadership’s proposals on Medicaid and the individual health insurance market will be the subject of an intense debate over the coming days. But when it comes to taxes, there is relatively little argument: The BCRA is an enormous tax cut that would largely benefit the nation’s highest income households.”

It Still Looks a Lot Like Obamacare: While much of the concern that senators have raised about the bill has been that it goes too far, there are enough conservative members of the chamber who believe the bill doesn’t go nearly far enough to sink it all by themselves.

Related: A GOP Senator Just Delivered a Serious Blow to the New Health Care Bill

The BCRA, like the House-passed American Health Care Act, relies on structures created by the ACA, like insurance exchanges and government subsidies to help people find and afford health care coverage. In the minds of some Republicans, like Kentucky Sen. Rand Paul, Texas Sen. Ted Cruz, Utah Sen. Mike Lee, and Wisconsin Sen. Ron Johnson, that’s unacceptable.

They want to see the ACA repealed root and branch, including new regulations placed on insurance providers, and replaced with what they consider a more market-oriented system. Any changes to the bill made to placate them are likely to drive Republicans at the other end of the party spectrum away, making passage of the bill a nearly impossible balancing act for Senate leadership.