Illinois’s Democratic-controlled General Assembly is about to enact its first budget in more than two years and end the partisan gridlock that produced an epic deficit crisis and drove the state’s credit rating to near junk-bond status.

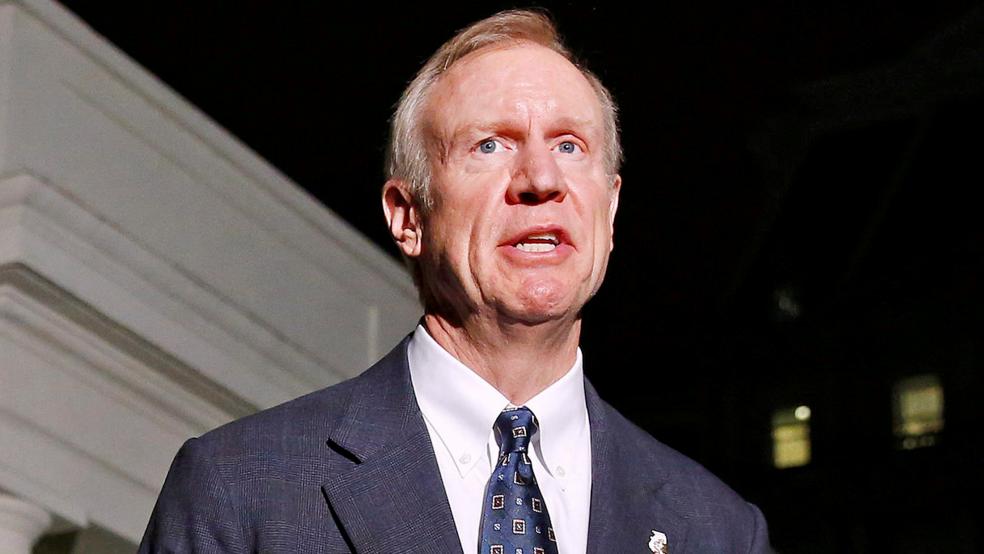

With the help of Republican defectors who grew weary of the stalemate between GOP Gov. Bruce Rauner and Democratic legislative leaders, the state House and Senate voted over the July 4th holiday to adopt a $36 billion budget package, including about $5 billion of increased income taxes on individuals and corporations.

Related: Why So Many State Budgets Are in Crisis Mode

The state Senate quickly overrode Rauner’s veto of the new taxes and spending package early Tuesday -- Independence Day -- while House Democratic leaders have scheduled an override vote on Thursday, to give them time to marshal their Democratic and Republican allies.

The improbable alliance of Democrats and mostly Down-State Republicans produced a hike in the state’s personal income tax rate from 3.75 percent to 4.95 percent and in the corporate income tax rate from 5.25 percent to 7 percent. But whether this heavy reliance on a more than 30 percent increase in taxes, without any fundamental changes in spending policies, will be enough to turn the tide and salvage the state’s credit ratings remains to be seen.

The Illinois legislative action come at a time when even conservative lawmakers in Kansas, South Carolina and Tennessee have recently agreed to significant new taxes to meet pressing demands for more revenue. Knee-jerk opposition to bolstering state taxes on personal income, corporate profits and gasoline to address financial crises may be a thing of the past.

However, Rauner and other critics in Illinois complain that there is nothing in the new budget package that would make structural reforms to slow the growth of long-term spending, especially the state employee pension fund.

Related: Could Illinois Be the First State to Go Bankrupt?

“Tax hikes have been tried in Illinois before,” according to Michael Lucci, vice president of policy for the conservative-leaning Illinois Policy Institute. “They’ve inevitably failed because they don’t fix the core problems of too much debt and too much spending.”

Illinois, the fifth largest state, is virtually on the edge of bankruptcy and is considered by many to be the poster child for a dysfunctional fiscal policy. The state ranks near the bottom of all states in providing adequate funding for its pension program for current employees and retired workers. Moody’s and Standard & Poor’s once again downgraded the general obligation debt of the state early last month, in the face of an unfunded pension obligation of at least $130 billion.

One of the reasons for that shortfall is that Democratic House Speaker Mike Madigan, one of the most powerful Democrats in the state and a close ally of state public employee unions, has battled with both Republican and Democratic governors over the years to protect the pension program from major reforms.

State officials have been forced to conduct business under court-ordered spending and stopgap measures while it has run up a huge $9.6 billion deficit. The state is also responsible for a backlog of unpaid bills totaling $14.7 billion, with many government programs and colleges still anxiously waiting for state aid.

Related: Nearly a Dozen States Are Suffering From ‘Chronic Budget Stress’

Rauner, a wealthy, conservative former businessman who is seeking a second term this year, has objected to a permanent rise in state taxes. He has argued instead for a temporary increase along with statewide property tax relief, and cuts in workers’ compensation and state employee pension benefits. Rauner warned that the legislature’s action “fails to address Illinois’s fiscal and economic crisis – and in fact makes it worse.”

“Budgets in Illinois won’t be balanced or stay balanced unless our economy grows faster than our government spending,” he told reporters. “We have been ignoring that truth for 35 years.”

Democrats insist they have taken steps to tighten spending to help address the state’s larger fiscal problems. For instance, the final budget plan would spend about $395 million less than an earlier bipartisan version advanced late last week. “While no one could say this was an easy decision, it was the right decision," Madigan said in a statement after votes approving tax increases and a spending bill.

Raising state income and corporate taxes by more than a third carries political risk, and indeed former Democratic Governor Pat Quinn lost a reelection bid in 2014 after supporting a move to make permanent a temporary income tax increase.

Related: States Face a $1 Trillion Pension Problem: Here Are the Worst 10

The state’s last big push for income tax increases, between 2011 and 2014, produced a political backlash against the Democrats and prompted a significant flight of wealthier residents and corporations from the state, according to IPI.

Standard & Poor’s on Monday called the tax increases and other legislative action a “meaningful step” but not necessarily a game changer.

“Even with a budget, however, it’s likely that Illinois’ finances would remain strained and vulnerable to unanticipated economic stress,” the agency said in a note.

“If a budget is enacted, the degree to which it closes the state’s structural deficit, provides a pathway for addressing the backlog of unpaid bills, and its impact on cash flows, will be important factors in our review of its effect on Illinois’ credit quality.”