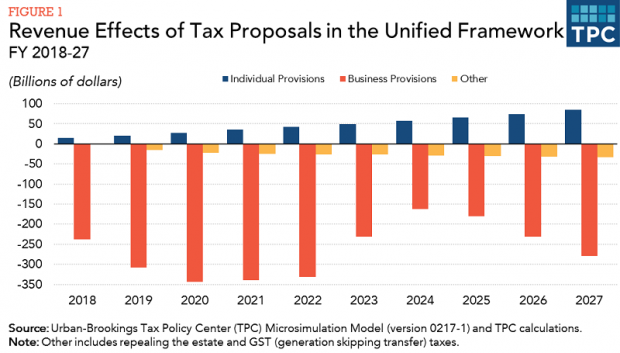

A new Tax Policy Center analysis of the Trump administration’s tax framework finds that the outline released this week would reduce federal revenues by $2.4 trillion over the first decade, and by $3.2 trillion over the following decade. Here’s a breakdown of the tax plan’s effects based on the TPC analysis.

Businesses really would get a huge tax cut overall. In the first 10 years, the federal government would lose $2.6 trillion in business tax revenues. Some of that loss would be made up for by increased revenues from individuals: The proposed changes would increase individual tax revenues by $470 billion over the first decade. This represents a substantial shift in the tax burden away from corporations and toward individuals.

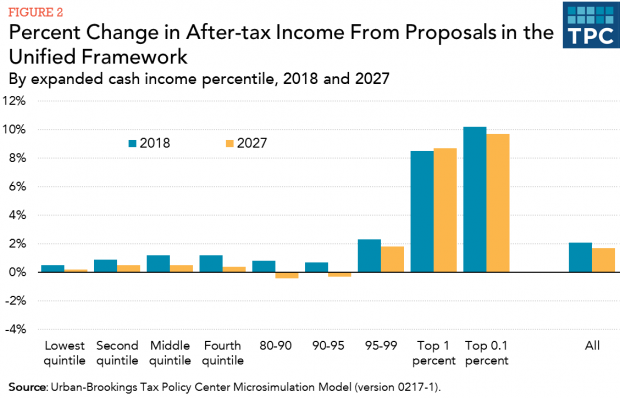

Half of the tax benefits on the individual side go to the top 1 percent. TPC found that individual tax bills would fall for all income groups on average, resulting in higher after-tax incomes, though some individuals could see increases, depending on their circumstances:

- In the first year, the average decline in taxes paid would be $1,600, raising after-tax incomes by 2.1 percent.

- The bottom 95 percent of taxpayers would see their after-tax incomes increase by between 0.5 and 1.2 percent in 2018.

- The top 1 percent of taxpayers — with incomes above $730,000 — would see their after-tax incomes rise by an average of 8.5 percent in the first year. The top 1 percent of taxpayers would receive about 50 percent of the total benefit, and the top 20 percent would receive 75 percent of the total benefit.

- Repealing the estate tax would cost $240 billion over the first ten years, and $440 billion over the next decade.

Not everyone benefits. In 2018, 12 percent of taxpayers would see their taxes increase by an average of $1,800. And more than a third of upper-middle income taxpayers, with incomes between $150,000 and $300,000, would pay more, due to the elimination of many itemized deductions.

- By 2027, taxes would rise for about one in four taxpayers, including almost 30 percent of those earnings between $50,000 and $150,000 and 60 percent of those earning between $150,000 and $300,000.

- By the end of the first decade, in 2027, taxpayers between the 80th and 95th income percentiles would see a small tax increase.

- From 2028 to 2037, a majority of upper-middle income taxpayers would see tax increases, due largely to the tax plan’s inflation indexing.

TPC, a joint venture of the Urban Institute and the Brookings Institution, had to make some assumptions in order to do the analysis due to the missing details in the GOP’s blueprint. For example, the framework fails to specify the income levels for the three individual tax brackets of 12, 25, and 35 percent. TPC used the House Republican’s “A Better Way” tax plan from 2016 to fill in those details.

The analysis was done on a static basis, meaning that it did not consider how the economy — and thus tax revenues — would change as a result of the revamped tax code. Republicans argue that any static analysis will fail to capture the positive revenue effects the tax cuts will generate. TPC said it would release additional estimates that include dynamic economic feedback, but it doesn’t expect to see much difference in the analysis.

On net, TPC finds that, even as most people would see their taxes come down, the federal government will be getting more money from individuals and less from corporations – a lot less. This may help explain why many Corporate America seems to be quite enthusiastic about the plan. As Robert Willens, a corporate tax expert, said in The New York Times: “This is much more than I think anyone could have hoped for. I’ve never seen something like this. Taken together, this is the most dramatic and beneficial group of corporate tax reform suggestions we’ve ever had.”