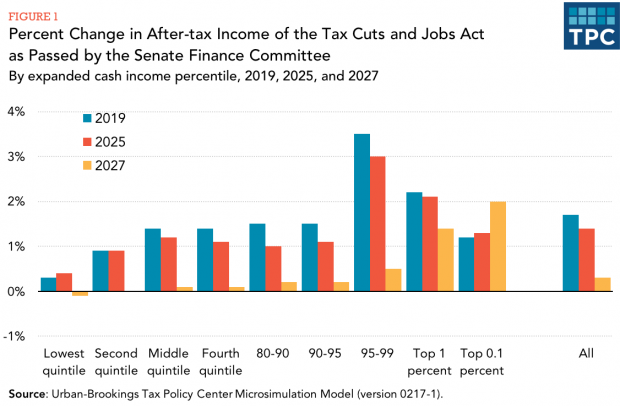

A distributional analysis by the Tax Policy Center finds that Senate’s tax bill would provide an average individual tax cut of $1,300 in 2019, but 8.5 percent of households would see their taxes go up that year. And the average tax cut would shrink over time, falling to $340 by 2027. At that time, after most of the individual tax provisions are set to expire, half of all households would pay more than they would under current law.

According to TPC, high-income households get a large share of the benefits, “with the largest cuts as a share of income going to taxpayers in the 95th to 99th percentiles of the income distribution.” At the same time, the outcomes of the bill are uneven, with the averages masking “disparate and idiosyncratic effects,” according to TPC’s Howard Gleckman.

Like what you see? Sign up for our free newsletter.

Gleckman’s summary of the analysis: “Proponents of the Finance panel’s tax plan aggressively promote it as a tax cut aimed at the middle-class and its critics argue that business and the wealthy would get all the benefits while middle-income households would get nothing. However, the story is much more complicated. On average, high-income households would do better than those with low- and moderate-incomes, but the fate of individual households will depend on where people live, how they make their money, how many kids they have, and what year we are looking at.”