You may have missed it as you were piling up the turkey and cranberry sauce, but the Organization for Economic Cooperation and Development released a report last Thursday that confirms that the U.S. is a low-tax country when compared to other developed nations.

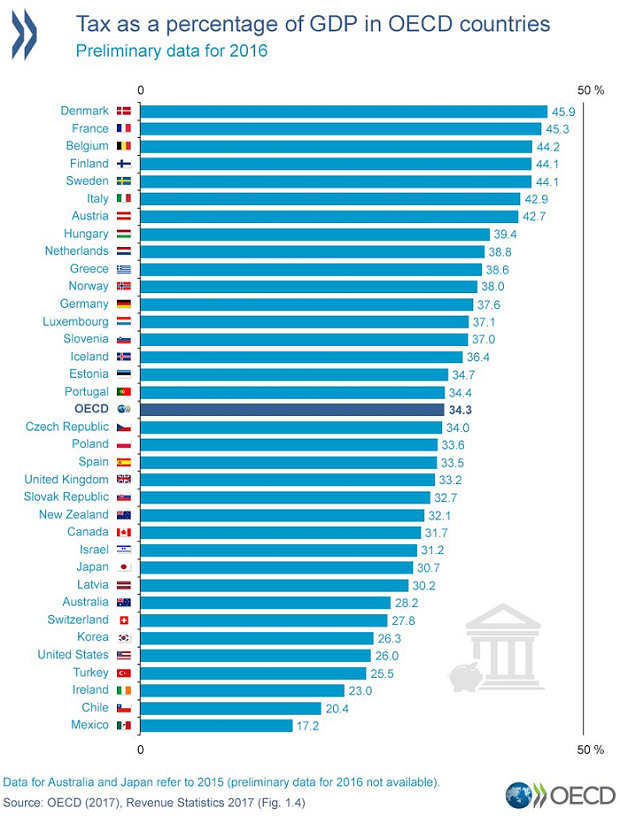

In 2015, the sum of all federal, state and local taxes in the U.S. was equal to 26.2 percent of GDP, and preliminary data for 2016 shows the percentage slipping to 26.0 percent. The recent figures are well below the recent peak of 28.2 percent recorded in 2000.

Like what you see? Sign up for our free newsletter.

The tax burden in most developed countries is considerably higher, with an average tax-to-GDP ratio of 34 percent in 2015 and 34.3 percent in 2016, and tax revenues are trending higher on average. For the OECD as a whole, taxes as a percentage of GDP are the highest level since 1965.

The U.S. ranks 31st out of 35 OECD nations on the measure, with only Turkey, Ireland, Chile and Mexico taxed less.

Taxes May Be Low, but Some Important Things Are Pricey

Bloomberg’s Justin Fox took note of the OECD report and provided a useful reminder that lower taxes don’t necessarily translate into bigger bank accounts. Americans may pay less in taxes than their counterparts in most developed countries, but they also face much higher bills for some basic goods and services, most notably health care and higher education. For example, while OECD nations on average spent 9 percent of GDP on health care in 2016, the U.S. spent 17.2 percent. In the end, Fox writes, “the net result is that while the tax burden in the U.S. is relatively low, U.S. taxpayers are burdened by other inevitable or near-inevitable expenditures that their counterparts in other wealthy countries don't have to worry about.”