Republicans have been saying their tax plan will allow Americans to file their taxes on a postcard – “a single, little beautiful sheet of paper,” in President Trump’s words.

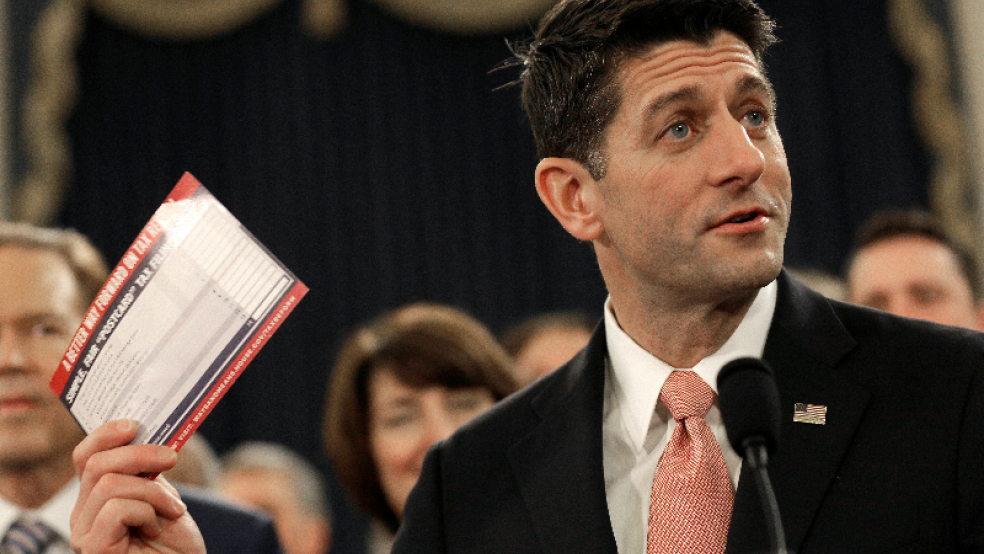

House Speaker Paul Ryan has been carrying such a postcard around for months as a prop to help pitch the plan, pulling it out of his suit pocket every chance he gets and waiving it around for the cameras as a kind of visual proof of concept.

But tax experts have their doubts about the claim. For one thing, who wants all their sensitive personal information floating through the mail system, exposed for all to see? “It’s kind of crazy to say you can file on a postcard when, first, no one is going to put their Social Security number on a postcard,” said Mark Mazur of the nonpartisan Tax Policy Center.

Besides, Mazur added, if you’re looking for a short and simple tax form, it already exists: “you already have a giant postcard in the form of the 1040EZ.”

The doubling of the standard deduction in the GOP tax plan, along with the reduction or elimination of other deductions, will mean that millions of people can use these shorter tax forms for their 2018 taxes (filed in 2019). But other changes under consideration, such as the curtailment of the state and local tax deduction, could require many households to continue making complicated calculations, especially wealthier taxpayers and people living in high-tax states such as New York and California.

“Even though we’re talking about simplification for a large number of taxpayers, there’s still many taxpayers who will have complicated tax situations,” said David Williams of Turbo Tax.

And as Reuters reports, the tax preparation industry thinks that there will still be plenty of work for them to do, whatever the final tax bill looks like.