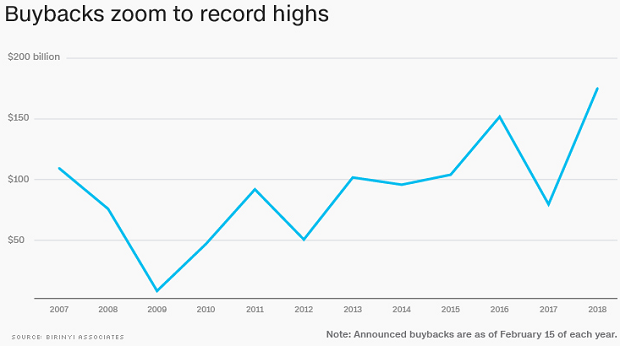

Companies are buying their own stocks at a record pace this year, according to Birinyi Associates, an investment firm in Westport, Connecticut. U.S. corporations announced $170.8 billion in stock buybacks between January 1 and February 15, the most since at least the 1980s, when Birinyi began collecting data.

While the motivation for the buybacks may vary from company to company, many analysts say the main driver of the buyback boom is the Republican tax bill, which slashed the top corporate tax rate from 35 percent to 21 percent. "It's the largest ever -- and nothing has really changed, except the tax law," said Jeffrey Rubin, Birinyi director of research, according to CNN Money.

A Morgan Stanley survey last week found that analysts expect companies to spend 43 percent of their tax savings on share buybacks and dividends. About 19 percent is expected to be allocated to mergers and acquisitions, 17 percent to capital investment and 13 percent to labor compensation.

The three largest buybacks announced so far this year are by Cisco ($25 billion), Wells Fargo ($22.6 billion) and Pepsi ($15 billion).