The Republican tax overhaul will decrease government revenue and increase the deficit by nearly $1.5 trillionover 10 years before accounting for any offsetting growth effects, according to estimates by the Congressional Budget Office and the Joint Committee on Taxation. But economists at Goldman Sachs say that the tax cuts are likely to be larger than initially forecast.

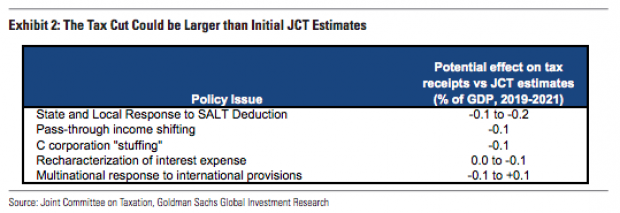

In a note to clients this week, Goldman economist Alec Phillips laid out two main reasons the tax cuts could reduce federal revenues by more than projected. First, the tax law relies on a new $10,000 cap on the deduction for state and local tax for much of the additional revenue it raises. But legislative efforts around the country to counteract that limit could shrink federal tax receipts. Second, taxpayers are likely to game the new code, for example by shifting income to pass-through entities to take advantage of the special treatment those businesses get.

Overall, Phillips says, such reactions to the law could increase the deficit by an additional 0.4 percent of GDP, or $80 billion to $90 billion just over the next few years — though he acknowledges that there’s significant uncertainty involved in the estimate. “Nevertheless, we expect that the risks over the next few years lean in the direction of a somewhat larger tax cut than was officially estimated,” Phillips concludes.

And the chances of Congress taking action to reverse any unexpectedly large revenue losses resulting from the Tax Cuts and Jobs Act appear slim, he says: “In light of the greater legislative obstacles the TCJA had to overcome, we expect that congressional Republicans and the White House would be less willing to modify it if the deficit widens more than expected.”