Thousands of public school teachers in Oklahoma entered the 10th day of their strike on Wednesday, part of a wave of labor protests by educators around the country. West Virginia teachers went on strike last month, inspiring ongoing protests in Arizona and Kentucky.

Michael Leachman, the director of state fiscal research at the Center on Budget and Policy Priorities, wrote recently that he sees a common fiscal thread in this labor unrest: “excessive state tax cuts that have shrunk state revenues and thereby made it harder for states to devote adequate resources to education.”

Oklahoma, Leachman writes, started cutting personal income tax rates in 2004 and reduced taxes on oil and gas production, driving the state’s annual deficit to $1 billion by 2016. Arizona has also reduced taxes in recent years, reducing its personal income tax rates by 10 percent and corporate tax rates by 30 percent. As a result, the states’ general funds have taken significant hits over the last decade, down 35 percent in Oklahoma and 30 percent in Arizona.

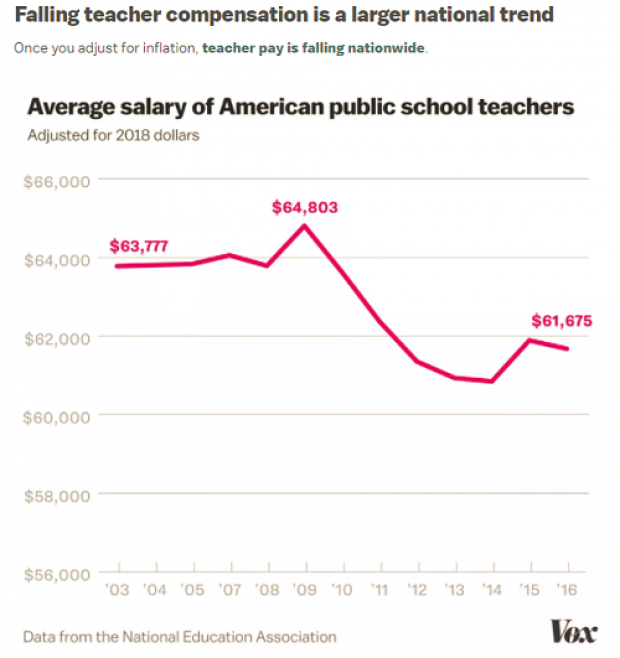

While the states experiencing protests are among the most severely affected – Reuters notes that they “have some of the lowest per-student spending in the country” – the effects of reduced public revenues and spending can be seen in national data as well. Annual average public-school teacher salaries in the U.S. fell by more than $2,000 between 2003 and 2016, according to data from the National Education Association cited by Vox:

Salaries are only part of the issue, though a significant one – Oklahoma educators are calling for a $10,000 per teacher pay increase, while in Arizona the request is 20 percent. More broadly, teachers are also protesting rising health care costs, changes in pension programs, and a lack of funding for buildings, books and other essential supplies.

Fixing the problem won’t be easy. Many of the states that have aggressively cut taxes in recent years have also made it hard to raise them again. “Reductions in state education funding largely due to tax cuts have limited pay and other resources for teachers,” Leachman writes. “And both Arizona and Oklahoma have supermajority requirements to raise revenue, which tend to lock in tax cuts once they’ve been enacted and make it difficult for these states to address shortfalls in education funding.”