We’re 200 days away from November’s midterms, and while we don’t want to get too far ahead of ourselves — 200 days, after all, could also be counted as about 20 Scaramuccis in Trumpworld — Goldman Sachs strategists are out with a useful look at what the elections might mean for policy in 2019.

The Goldman team assumes that Democrats will take control of the House but not the Senate, which seems the most likely outcome at the moment. Such a divided government could lead to two very different results, the strategists write.

In one scenario — let’s call it the optimistic view — “bipartisan cooperation could lead to new legislative actions in rare areas of political agreement,” including drug pricing and infrastructure investment. That would at least be something, although it’s worth noting that we’ve all heard that before and it hasn’t quite worked out as we hoped.

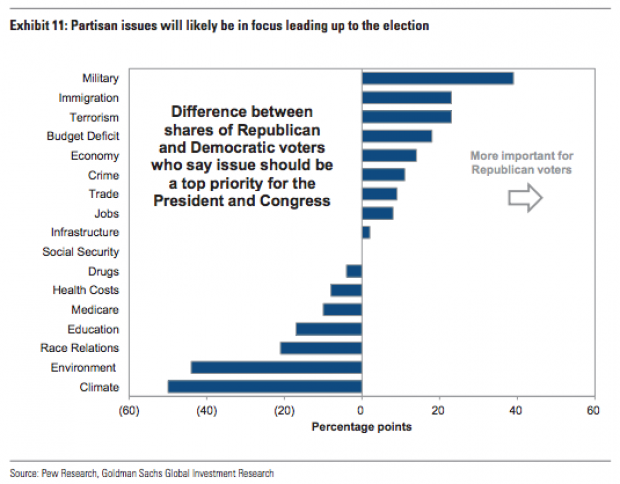

In the more pessimistic scenario, any kind of compromise might prove impossible given a divided government and our current political environment. In this case, “the legislative engine could grind to a halt amid partisan conflict, which would create a different set of policy winners and losers.”

Here’s more on what divided government might mean for drug prices and infrastructure, based on Goldman’s report:

Health care costs: “Drug prices in particular have long been a stated focus of members of both parties, and recent headlines suggest that President Trump will give a speech on prescription drug prices later this month,” the Goldman strategists say. They also note that the bank’s political economist believes that Congress might be more likely to implement some of the drug pricing proposals put forth by the Department of Health and Human Services this year if Democrats win the House. But political clashes might mean nothing gets done.

Infrastructure and Government Spending: Both President Trump and Democrats have talked about investing in infrastructure, but the chances of something getting done appear small given the partisan divide and the worsening outlook for the budget deficit after enactment of the Republican tax cuts and a $1.3 trillion spending plan. “From a macro perspective, our political economists have highlighted that a divided government would increase the likelihood of passive fiscal tightening in early 2020,” the report says. Such tightening would occur if lawmakers fail to provide any new fiscal stimulus as the positive economic effects from the tax cuts fade.

For now, it seems that the only certainty is more uncertainty and volatility ahead of the elections — and after them as well, if a divided Congress leads to tighter oversight of the Trump administration and a two-year legislative stalemate.