Companies in the S&P 500 are increasing spending on their businesses at the fastest rate since 2011, The Wall Street Journal reports.

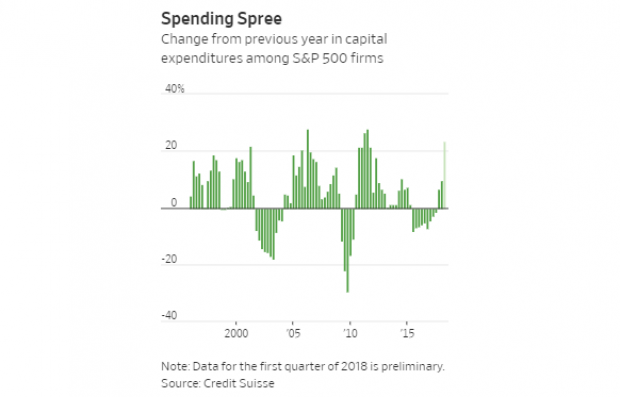

Capex investment, which includes things like building factories and office buildings and buying new equipment, is expected to hit $166 billion in the first quarter, an increase of 24 percent over the year before. Spending is increasing as companies start spending some of the huge cash reserves that have been piling up in the wake of strong economic growth, with profits now boosted even more by the business tax cuts that became law earlier this year.

The bump in capex investment has played a role in the current debate over the efficacy of the new tax law. The RATE collation, a tax reform group backed by major corporations, offered support for the new rules Wednesday, saying in a statement, “In the most important measures — from record high job openings to record low jobless claims, soaring small business confidence to a surge in capital spending — it is abundantly clear that tax reform is helping grow our economy and create new jobs.”

But most experts say the long-term effects of the tax cuts will take years to evaluate. And not everyone agrees that the recent increase in capex spending represents a fundamental change in the economic environment. As Democratic financier Steven Rattner noted in his testimony before the House Ways and Means Committee Wednesday, “there is no sign that the promised investment boom has materialized. Indeed, real domestic private investment has risen at an annual rate of just 3.8% since the current administration took office compared to 6.3% from 2010 through 2016.” And the chart below from The Wall Street Journal suggests that the bump in capex spending could also be cyclical in nature.