Round One was bad. Round Two would only make things worse. That’s the argument Seth Hanlon and Galen Hendricks of the liberal Center for American Progress make in a new analysis of additional tax cuts being considered by President Trump and congressional Republicans.

“Round two of the Trump-Republican tax plan would compound the damage already done in the first round by giving even more tax cuts to high-income Americans, causing long-lasting damage to the federal budget, and further threatening priorities such as Social Security, health care, and education,” the authors write.

The new tax law’s individual and estate tax provisions are currently set to expire after 2025. Making those cuts permanent would be problematic for a few reasons, the authors argue:

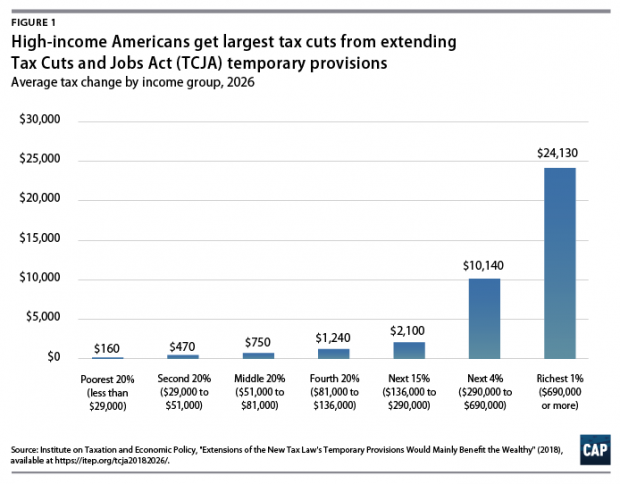

1. It would further skew the overhaul’s benefits to the wealthy, they say, citing previous estimates from the Institute for Taxation and Economic Policy.

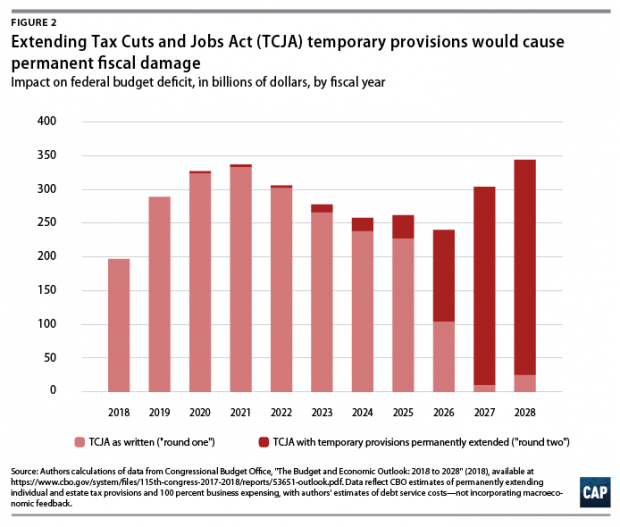

2. As other analyses have shown, a second round of tax cuts would explode the budget deficit after 2025. “Congressional Republicans have already made it clear that they wish to pay for their tax cuts by cutting critical services such as Social Security, Medicare, and Medicaid. Hiking deficits by piling on more top-heavy tax cuts would only hand them a bigger excuse to do so,” the authors argue.

3. “Making a deeply flawed tax law permanent would take away the chance to fix it.” The 2025 expiration of individual tax cuts creates an opportunity for lawmakers to revisit the law and take another shot at reforms that prioritize working- and middle-class families.