A Wall Street Journal editorial this past weekend took aim at the idea that the Republican tax cuts have much to do with rising deficits. “Perhaps you’ve read that the federal budget deficit is rising again, and that’s true,” the Journal’s editorial board said. “But what you probably haven’t heard is that the main reason is spending, not falling revenue from tax cuts.”

The deficit is indeed growing, up $116 billion over last year, but the Journal cited higher federal spending to the tune of $143 billion as the cause. With revenues up by $26 billion, how can the tax cuts be to blame? “[D]on’t believe everything you read about tax reform and deficits. Higher spending is the real problem,” the piece concluded.

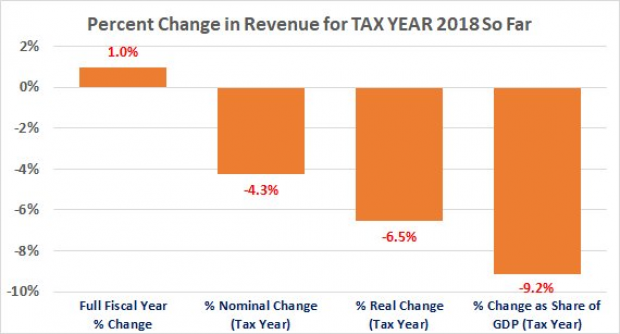

Critics, however, were quick to jump on the claim, led by Marc Goldwein of the Committee for a Responsible Federal Budget. The Journal’s “misleading” analysis, Goldwein said in a long twitter thread, is based on nominal data for the 2018 fiscal year, and the increase in revenue disappears as soon as the inflation is factored in. More fundamentally, it doesn’t make much sense to include data from last fall when analyzing the effects of the tax cuts, Goldwein said, since the legislation didn’t go into effect until this year, and the numbers include larger-than-expected tax revenues from the 2017 tax year. Looking at just the 2018 calendar year, it’s clear that tax revenues are indeed falling.

Here is Goldwein’s chart showing the corrected data:

But The Wall Street Journal editorial board doesn’t have to take Marc Goldwein’s word for it. They can simply read this news report on recent U.S. Treasury data in their own paper from last week:

“Government revenue fell 3% last month compared with a year earlier, while spending grew 10%.

Deficits are rising partly because business and individual tax rates were cut last year while government spending has been ramped up.

Gross corporate tax revenues fell 34% in July from the prior year, while taxes from individual withholding fell a smaller 1%.”