Larry Kudlow, the director of President Trump’s National Economic Council, is once again talking up the economy and talking down the threat posed by rising debt and deficits. And once again, he’s providing fact-checkers plenty of work.

In an appearance at The Economic Club of Washington, D.C., Kudlow said we’re in the midst of an unexpected economic boom resulting in large part from the administration’s agenda of tax cuts and deregulation — and, contrary to many economists’ expectations, he again argued that the benefits would be lasting. “This is not a sugar high,” he said.

Asked whether he was worried about $21 trillion national debt and annual budget deficits that are projected to rise above $1 trillion, Kudlow was blunt: “No, not at the moment,” he said.

Here are other key quotes from Kudlow’s interview, with some fiscal fact checks. Watch Kudlow’s speech and interview here.

On economic growth and the deficit: “I’ve never been much of a deficit hawk. ... I’m just saying growth is going to solve a good deal of that deficit and the debt burden on the economy. If we get the kind of growth we’re looking for over a period of 10 years or more, that is going to be an enormous help. And I believe the deficit-to-GDP ratios will be coming down — not immediately, I get that. But I think they will over time.”

Fact check: As we’ve pointed out before, the Committee for a Responsible Federal Budget has said that stabilizing debt at its current size as a share of the economy — about 77 percent of GDP — would require annual growth of 4.2 percent, or 5.2 percent under a scenario in which, among other things, the individual tax cuts enacted last year are made permanent and federal spending rises with inflation instead of falling back in line with spending caps.

On the drivers of the deficit: “Mick Mulvaney, our OMB budget director … he has shown, actually, the biggest part of the deficit is not the big entitlements. … It’s actually discretionary spending across the board. Now, that includes things like food stamps and welfare. And the president wants workfare put into all these programs. … But there’s a lot of extraneous stuff in this budget. So we could make a big dent in spending, and I think you’ll see this, without worrying about the big entitlements. Let’s just look at the bread and butter stuff that goes on every day.”

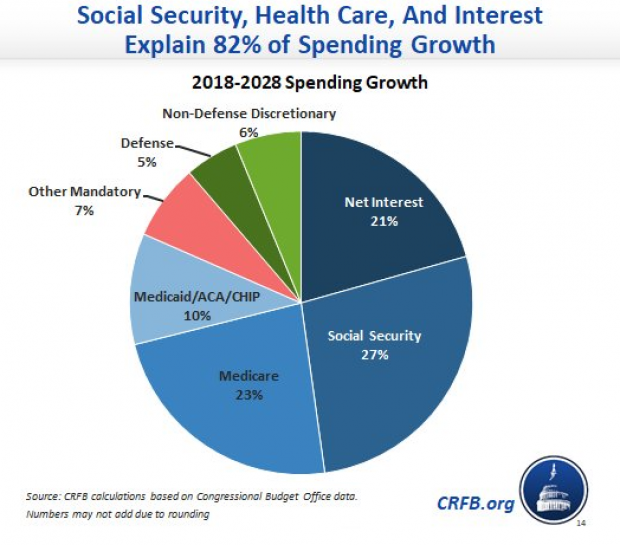

Fact check: The Congressional Budget Office suggests otherwise. In its long-term budget outlook published in June, it said that, “Over the next decade, mandatory spending (which includes spending on Social Security and the major health care programs, along with many smaller programs) is generally projected to increase as a share of the economy, and discretionary spending is generally projected to decrease.”

And Zach Moller, a policy analyst at the Committee for a Responsible Federal Budget, tweeted out this chart:

On the need for spending cuts: “The other factor [in reducing the deficit] is there must be greater spending limitation. There’s no question about that. Grow the economy, trim spending, go for a more modest government. We’ve done it on the regulatory front. I think you’ll see a tougher line on the spending front.”

On his recent comments that the administration might look at entitlement reform next year: “I was saying we are going to continue to reform and erase the vestiges of Obamacare, with which we disagree enormously. … I was talking about Obamacare. To be very clear, we have no plans to deal with the big entitlements right now. We have enough on our plate with Obamacare.”

On the Federal Reserve: “The Fed is independent. They’re going to do what they’re going to do. … The president has his opinions and he gives them, which is great, but he’s said he’s not forcing them, pushing them or trying to apply any pressure. He’s just giving them his views.”