The U.S. had one of the highest corporate tax rates in the world prior to the passage of the Republican tax overhaul last December, but as many critics of the law pointed out, companies rarely paid the full statutory rate. Once the many deductions and loopholes in the tax code were taken into account, the effective tax rate was considerably lower for most businesses.

According to an analysis by the Congressional Budget Office last year, the corporate tax rate of 39 percent – which includes both the statutory 35 percent federal rate and various state-level taxes – translated into an average effective rate of 29 percent for businesses in 2012. Another measure, the marginal effective tax rate, which gauges the tax burden on new investments, was an even lower 18.6 percent. Even so, U.S. rates remained among the top four highest among G20 nations on each measure.

However, a new report from economist Matthew Higgins of the New York Federal Reserve Bank suggests that effective corporate tax rates were considerably lower than the CBO’s analysis indicates, and have moved markedly lower as a result of the GOP tax law.

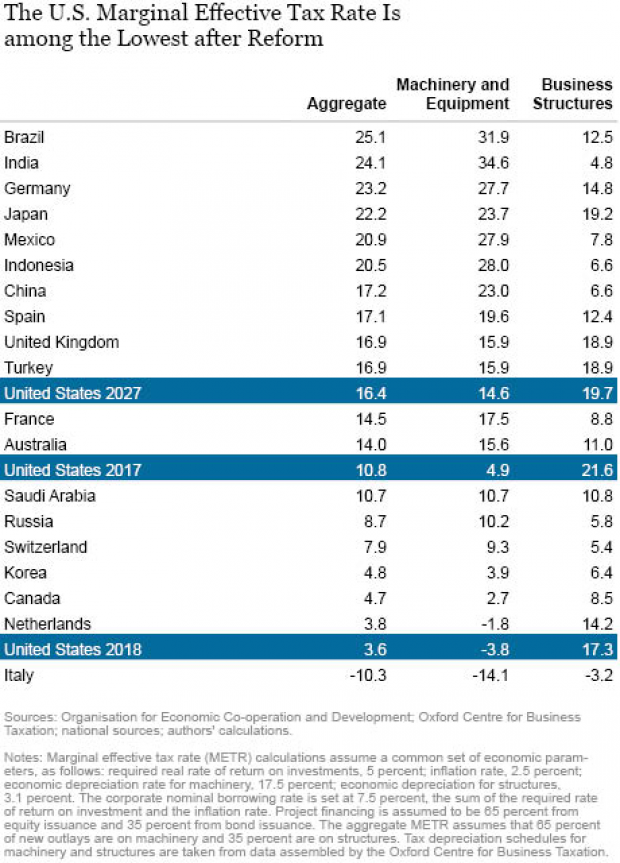

Higgins calculated a different version of the marginal effective tax rate (METR), taking into account things like depreciation deductions, inflation and financing costs. Viewed through this lens, the U.S. already had a below-average tax burden compared to other large economies before the GOP law went into effect. The METR for the U.S. – the higher the METR, the greater the tax burden on businesses looking to deploy capital in new ways – was 10.8 percent in 2017 (see the chart below), compared to 13.8 percent for the rest of the top 20 global economies. With the reduction of the top federal corporate tax rate to 21 percent starting in 2018, the marginal effective tax rate has dropped to 3.6 percent – the second lowest among the top 20 economies.

Higgins notes that the new tax rules are exceptionally favorable toward investments in machinery: “Prior to enactment of the TCJA, 50 percent of new machinery expenditures could be written off immediately and most of the rest could be deducted from income over the first three years of a project. The result was an estimated METR for machinery of just 4.9 percent. Under the TCJA, 100 percent of most machinery investments can be expensed. In essence, the U.S. tax code now subsidizes machinery investment, with the METR at -3.8 percent.” The machinery deduction is scheduled to phase out by 2027, however, but even so, the marginal effective tax rate will be 14.6 percent, still lower than average.

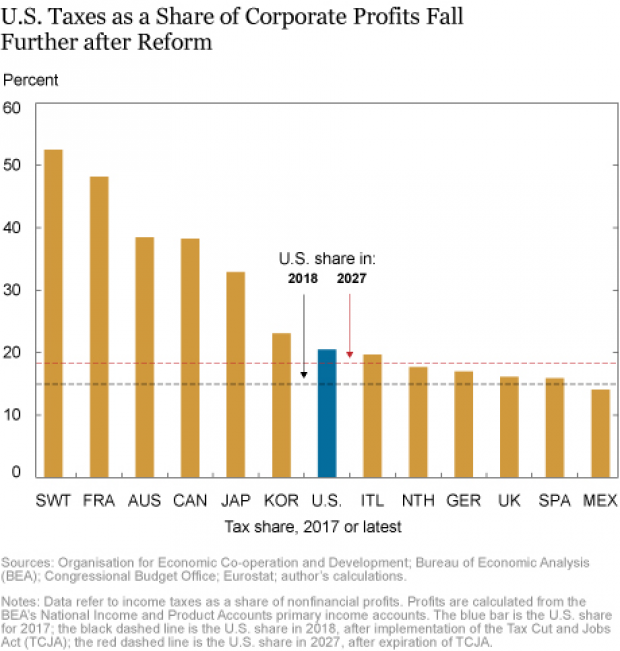

Higgins also looked at how high taxes are relative to corporate profits, saying that “what matters to international investors is the share of investment returns actually collected as taxes.” Although the data makes direct comparisons difficult, Higgins concludes that corporate tax payments relative to profits were already low in the U.S. compared to other Organisation for Economic Co-operation and Development nations. Before the new tax rules came into effect, taxes paid amounted to about 20 percent of profits, and Higgins estimates that tax payments will fall to about 15 percent of profits in 2018 – one of the lowest in the industrialized world.