Workers in many industrialized countries pay more in taxes than Americans do, but those workers also receive more benefits in exchange – benefits that American workers pay for separately. As a result, comparisons of tax rates across countries can be misleading, since they fail to capture payments made for similar benefits. The most important difference centers on health care, which most Americans pay for privately, along with their employers.

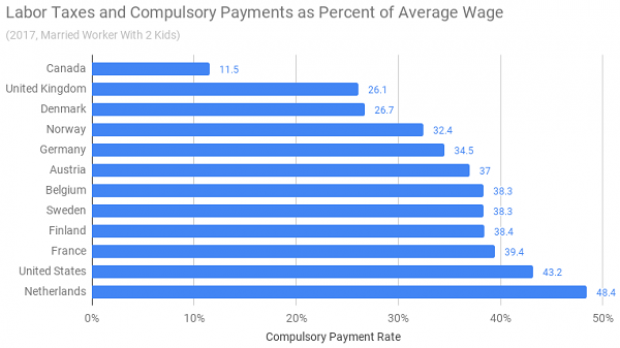

Using recent data from the OECD, Matt Bruenig of the liberal People’s Policy Project calculated “compulsory payment rates” across countries that include income taxes paid by employers and employees and add in the insurance premiums paid by both parties as well. Once American insurance premiums are included, the overall “tax” rate looks quite different in cross-national comparisons, with the U.S. rising near the top in compulsory payments paid by labor (see the chart below).

The upshot, Bruenig says, is simple: Americans “don’t pay as many formal taxes as [Europeans] do, but when you bring in payments we are compelled to pay and that are deducted straight out of our paychecks just like taxes are, it really does not look that much different, at least as far as labor taxes are concerned.” And Bruenig says this makes the case for universal care that much stronger. “American workers already pay more than enough money to provide good health care to everyone in the country. It’s just that they pay it into a private insurance system that wastes large portions of it on rents and administrative redundancy.”