One common concern about the Republican tax overhaul is that it has weakened the country’s ability to combat the next recession. Some experts worry that the tax-cut driven increase in the budget deficit – which could hit $1 trillion as soon as this year – will make it harder for politicians to respond to an economic downturn with new fiscal stimulus. This reduction of “fiscal space” could serve as a political and perhaps economic constraint on federal officials as they seek to boost unemployment benefits, fund infrastructure projects or provide temporary tax relief to workers in the midst of a recession.

In short, bigger deficits now could mean less federal spending later when the economy really needs it.

Economist Josh Bivens of the liberal Economic Policy Institute argues in a new paper that while the U.S. is indeed ill-prepared to face the next recession, fiscal space is not the issue. While the debt-to-GDP ratio has risen sharply in the last 10 years, more than doubling to about 77%, Bivens says that number is not inherently problematic, however much fiscal hawks see it as a looming constraint.

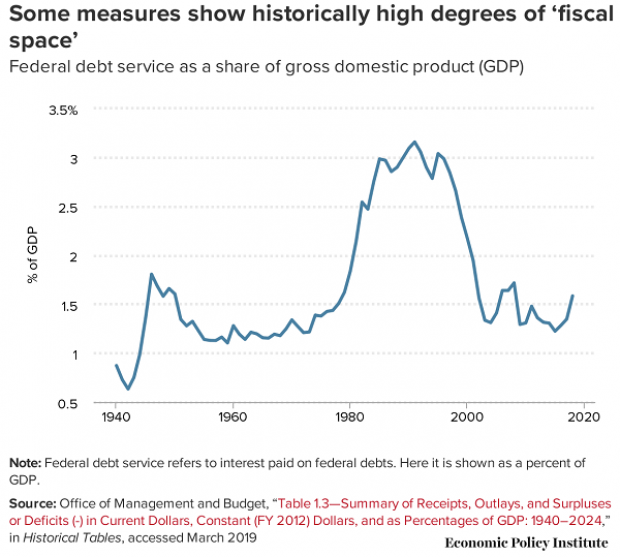

As an alternative, Bivens recommends looking at other fiscal variables, including the cost of federal debt service as a share of GDP. Low interest rates, which in part reflect a lack of concern in the markets over growing U.S. deficits, mean that the cost of servicing the debt is modest by historical standards (see the chart below). By that measure, the U.S. has plenty of fiscal space to “do the right thing in the next recession,” Biven writes.

The bottom line: Economists will disagree about how much fiscal space the U.S. has at any given moment, but the idea is inherently a matter of perception – and politics. The federal response to the next recession will depend to some extent on the perceived level of debt at the time, and the political interests of policymakers as they open the fiscal toolbox.