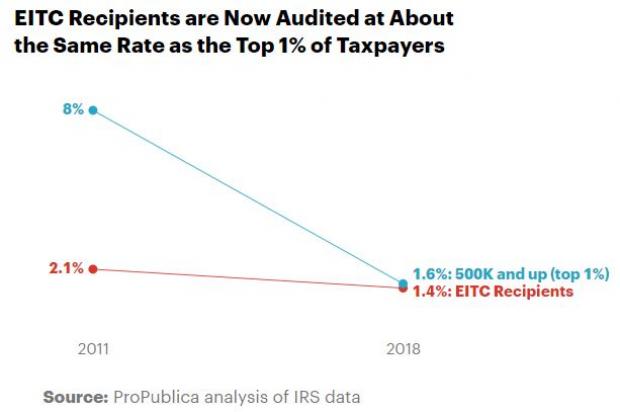

Last year, millionaires were about 80% less likely to be audited by the Internal Revenue Service than they were in 2011, ProPublica’s Paul Kiel reported recently, based on government data. Meanwhile, audits of the poor — specifically, Americans who receive the earned income tax credit (EITC), who typically have annual income under $20,000 — have held steady. The result is that audit rates for EITC recipients and the top 1% of earners are converging, as shown in the ProPublica chart below.

“Part of the reason is ease,” Kiel writes. “Audits of EITC recipients are largely automated and far less complicated.” The EITC audits carry a secondary effect, too, he explains: “They’ve discouraged hundreds of thousands of families who might qualify for the credit from claiming it in future years.”