The import tariffs proposed by President Trump could wipe out the income gains provided by the Republican tax cuts for low- and middle-income earners, Jim Tankersley of The New York Times reported Monday.

The Trump administration has already imposed or increased numerous tariffs on imports, including a 25% levy on $200 billion worth of consumer and manufacturing goods from China that went into effect in May. If those tariffs remain in effect, they will cost the average household about $831, according to analysts at the New York Federal Reserve Bank.

The president also has threatened to impose tariffs of up to 25% on all Mexican imports to punish the country for its failure to break up what White House trade adviser Peter Navarro called "transnational criminal organizations" that facilitate illegal immigration in the U.S., and to impose new tariffs on another $300 billion worth of imported Chinese goods. He is also weighing tariffs on autos from Europe and Japan.

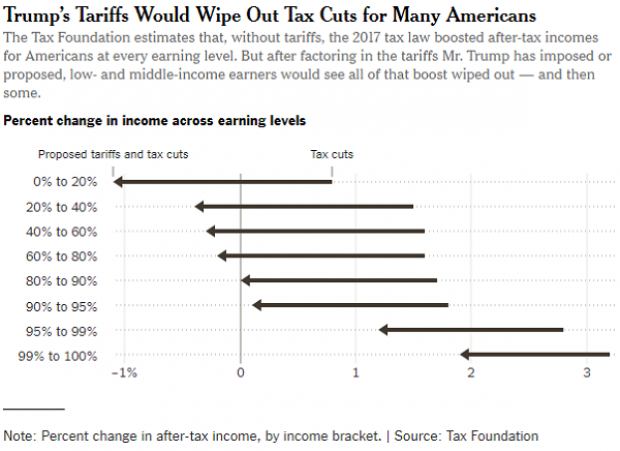

A new tax on American consumers: An analysis of the effects of the existing and threatened tariffs by the Tax Foundation found that higher prices on consumer goods would not only wipe out income gains from the GOP tax cuts for the majority of U.S. households, but would in effect impose a new tax that would leave most people worse off.

The bottom 20% of taxpayers would see an effective tax increase of 1.1%, the analysis found, while those in the middle fifth would see an effective tax increase of about 0.3%. The top 10% of households would still be better off, though their tax cut income gains would be eroded (see the chart below).

“Once you start adding in the tariffs and start talking about what Trump wants to do at the end of the day, it gets harder and harder for Trump and Republicans to claim that they are cutting taxes for the middle class,” said Kyle Pomerleau, the Tax Foundation’s chief economist.

Low-income earners hit the hardest: Saying that the tariffs could “boomerang on U.S. consumers and companies,” Josh Boak and Jonathan and Cooper of the Associated Press emphasized Tuesday that low-income Americans would get hurt more than anyone else as dollar-store chains and Walmart raise their prices due to increased costs from the tariffs. Poorer Americans spend a higher percentage of their incomes overall, and more of it goes toward basics that are exposed to tariffs.

“The people likely to pay the steepest price for Trump’s attempts to bend Mexico and China to his will are poor Americans, who already live close to the financial edge and could have to pay more for everyday purchases,” Boak and Cooper said.

The Tax Foundation’s Pomerleau agreed, saying that if the tariffs remain in place, the bottom fifth of households could end up worse off under Trump’s presidency. “You’re looking at an administration that may have raised taxes on the bottom 20% and cut taxes for the top 1%,” Pomerleau said.