The Trump administration is considering issuing an executive order that would index capital gains to inflation, Bloomberg News reported last week. “Indexing capital gains would slash tax bills for investors when selling assets such as stock or real estate by adjusting the original purchase price so no tax is paid on appreciation tied to inflation,” said Bloomberg’s Saleha Mohsin.

Arguing that it would be “the most useless and regressive tax cut ever,” Matt O’Brien of The Washington Post highlighted the degree to which the benefits would flow to the wealthiest taxpayers.

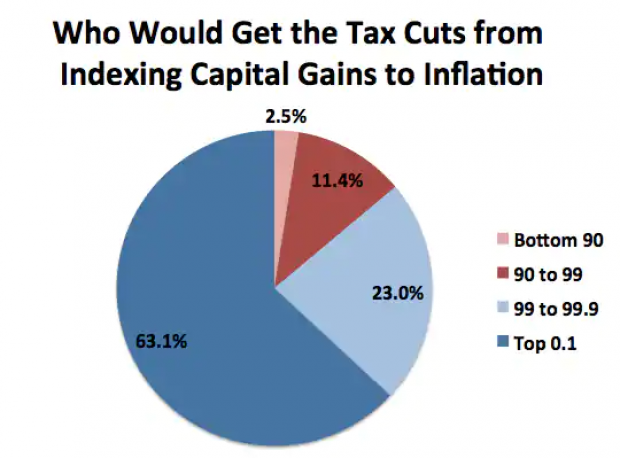

“[A]ccording to the nonpartisan Penn-Wharton Budget Model, indexing capital gains to inflation would only give 2.5 percent of its total tax cut to the bottom 90 percent, 11.4 percent to the 90 to 99 percent, 23 percent to the 99 to 99.9 percent, and a whopping 63.1 percent to the top 0.1 percent alone,” O’Brien wrote Saturday.

“To put that in perspective, the top 0.1 percent of households would get a 25 times bigger tax cut than the bottom 90 percent combined.”