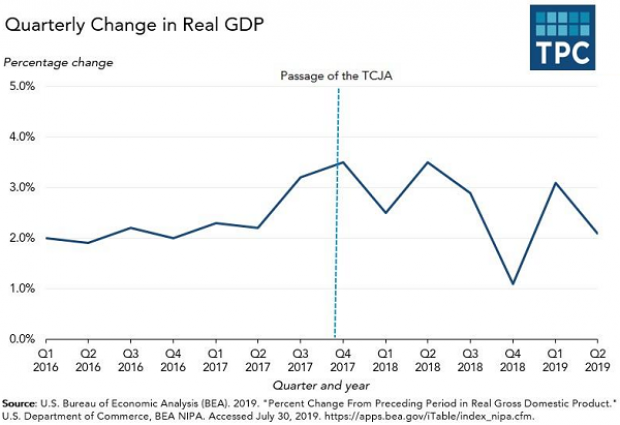

The Republican tax cuts, combined with a big jump in government spending, produced a period of faster economic growth over the last year and a half, according to an analysis by Howard Gleckman and Aravind Boddupalli of the Tax Policy Center, but that burst of elevated activity appears to have come to an end.

“The US economy grew robustly in late 2017, perhaps partly due to expectations for a coming tax cut, (which Congress passed in late December of that year),” Gleckman and Boddupalli write. “But the rate of growth peaked in the second quarter of 2018 and has been slowing ever since.”

According to last week’s latest GDP growth estimate from the Commerce Department, the economy is now growing at about 2.1 percent annually – the same rate as before the tax cuts took effect. “The economic benefits of the Tax Cuts and Jobs Act (TCJA) seem to have petered out,” Gleckman and Boddupalli conclude.

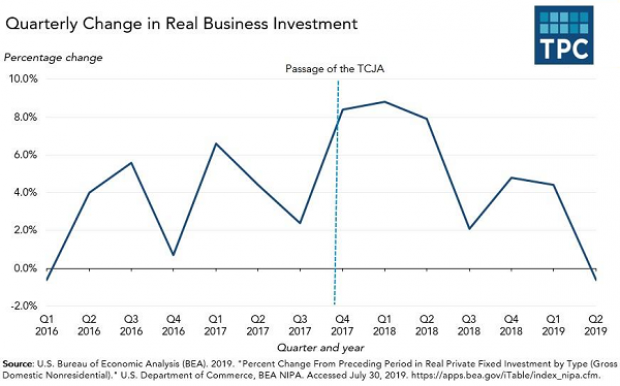

The latest economic data also show that business investment – one of the key factors Republicans cited in their argument for the tax cuts, which were supposed to motivate companies to make long-term investments and thereby boost economic growth on a permanent basis – has not only dropped off but turned negative. “This slowdown in business purchases of plant and equipment contrasts sharply with President Trump’s rosy forecast of a long-term investment boom that would lead to annual wage increases of $4,000 or more,” Gleckman and Boddupalli write.

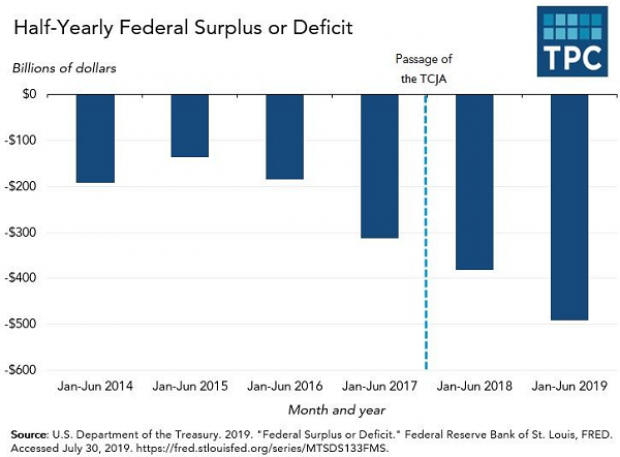

At the same time, the tax cuts are a major contributing factor to the soaring deficit, which is expected to reach about $1 trillion this year despite solid economic growth, and remain at that level for years to come.

The Reason for the Flop

Economist Paul Krugman has a similar take on Trump’s track record, arguing in The New York Times Friday that Trump’s two main economic policies – tax cuts and tariffs, both intended to boost manufacturing – have flopped. The tax cuts failed to produce a surge in business investment while the tariffs imposed as part of the president’s trade war with China are now dragging on the economy, so much so that Federal Reserve chief Jay Powell announced the first interest rate cut in more than 10 years as part of an effort to ensure that the economy keeps growing.

Citing the long history of failed tax cuts, including those by President George W. Bush and Kansas Gov. Sam Brownback, Krugman says that “[t]here was never any reason to believe that cutting corporate taxes here would lead to a surge in capital spending and jobs, and sure enough, it didn’t.” Business investment is complicated and tax rates are “way down the list” when it comes to making decisions about expansion, the economist says.

The bottom line: No one is arguing that the economy is in ruins due to Trump’s policies. Growth is still positive, job creation is chugging along and wages are finally rising, especially for lower-income workers — factors Trump will cite as proof that his policies have worked. But Trump and Republicans promised that their economic plans would result in lasting, structural improvements, and those don’t appear to have materialized.

Krugman says the real question is how much stronger the economy could be if Trump’s policies had been different. “Imagine how much better shape we’d be in if the hundreds of billions squandered on tax cuts for corporations had been used to rebuild our crumbling infrastructure,” he writes. “Imagine what we could have done with policies promoting jobs of the future in things like renewable energy, instead of trade wars that vainly attempt to recreate the manufacturing economy of the past.”