We live in unusual and unsettling economic times. Today’s evidence of that came via two mind-blowing market numbers, 1.6% and $15 trillion.

The first represents the yield on 10-year U.S. Treasuries, which briefly fell below 1.6% on Wednesday, hitting the lowest point since 2016 before turning slightly higher. Touching 2.12%, the yield on the 30-year Treasury moved near the record low of 2.089% recorded three years ago.

Those ultralow yields are driven by investors worried about the slowing global economy and a possible U.S. recession triggered by President Trump’s escalating trade war with China. In response, they’ve piled into relatively safe government debt.

Ten years ago, the idea that the U.S. national debt could swell above $22 trillion and rates would still be near record lows might have been laughed at. But that’s the reality today.

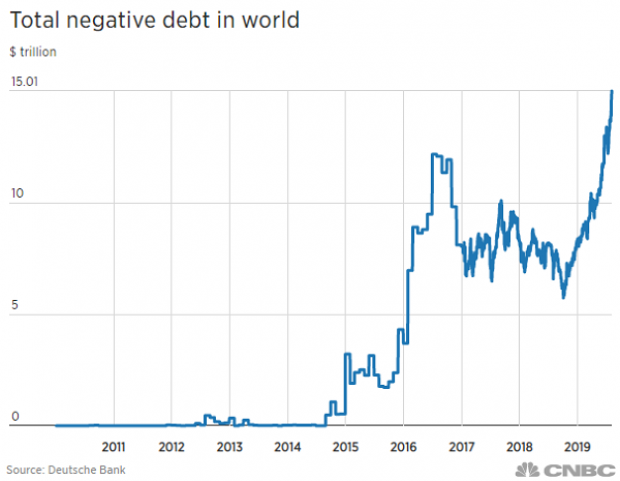

The second number, $15 trillion, represents the global supply of debt that is trading at negative yields — that is, investors paying governments to hold their money, a reversal of the usual arrangement.

There are currently at least 11 countries that have negative yields on their 10-year debt, Bloomberg News reports. For example, the German 10-year note was at -0.57% Wednesday, while the Japanese 10-year was at -0.19%.

According to Deutsche Bank, there is now $15 trillion worth of bonds trading at negative yields, or about 25% of the market, and that number has more than doubled in the last year.

Could the U.S. Be Next?

Long seen as one of the safest places in the world to store money, U.S. Treasuries have avoided negative yields so far, but Joachim Fels of investment giant Pimco says the next recession may change that.

“Whenever the world economy next goes into hibernation, U.S. Treasuries – which many investors view as the ultimate ‘safe haven’ apart from gold – may be no exception to the negative yield phenomenon,” Fels wrote Tuesday. “And if trade tensions keep escalating, bond markets may move in that direction faster than many investors think.”

While short-term worries about trade wars and recession are no doubt adding to the downward pressure on yields, Fels argues that there are long-term causes of the global move toward low and negative rates. Technology is lowering the cost of capital, reducing demand for investment capital, while an aging society increases the demand for the preservation of capital, even at the cost of negative returns. Together, those trends point toward lower yields in the long run.

When the next recession comes, the Federal Reserve may have to reduce interest rates back to zero, as it did during the previous recession, Fels says. But against a backdrop of deep technological and demographic change, zero interest rates may not be enough to restart the economy. If that’s the case, “negative yields on U.S. Treasuries could swiftly change from theory to reality.”

Bank of America strategist Bruno Braizinha told Bloomberg News that while he isn’t predicting that the U.S 10-year will go negative, he could see it falling below 1% if the Federal Reserve starts aggressively cutting rates in response to a slowdown. “Yield is evaporating globally,” Braizinha said. And if the Fed does drop rates back down to zero, Braizinha says that negative U.S. interest rates are a distinct possibility.