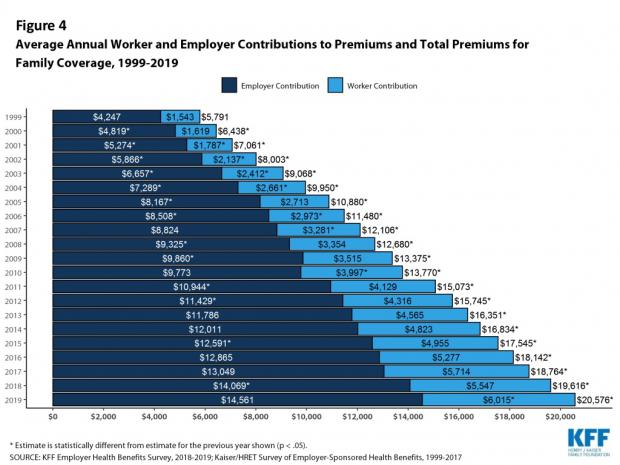

The average cost of employer-provided health coverage now tops $20,000 for a family plan, according to a new survey by the nonprofit Kaiser Family Foundation.

Annual premiums for an employer-provided family plan rose to $20,576 this year, up 5% from last year, the annual survey found, with workers paying an average of just over $6,000 toward their coverage, up 8% year over year.

“It’s the cost of buying an economy car, just buying it every year,” said Drew Altman, president and CEO of the foundation.

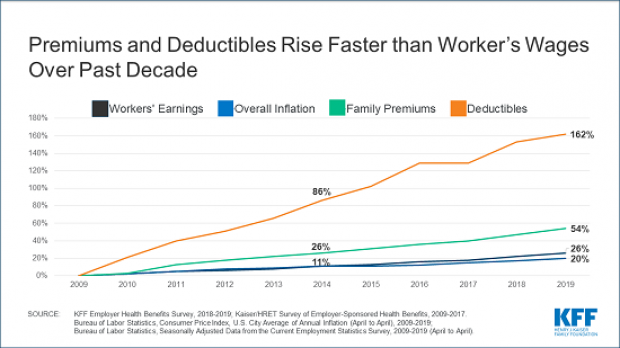

Since 2009, average family premiums have risen 54% and workers’ contributions have soared 71%, far faster than the growth in wages (26%) and inflation (20%), according to the foundation.

“The single biggest issue in health care for most Americans is that their health costs are growing much faster than their wages are,” Altman said. “Costs are prohibitive when workers making $25,000 a year have to shell out $7,000 a year just for their share of family premiums.”

Deductibles rising, too: The average deductible for individual coverage, or the amount employees have to pay out of pocket before their insurance begins covering claims, rose to $1,396, up from $1,350 last year and $533 a decade ago. More than 80% of covered workers now have a deductible, up from 63% a decade ago. Taken together, the increasing prevalence and cost of deductibles have resulted in a 162% total increase in the burden of deductibles across all covered workers over the past decade, the foundation says. More than one in four covered workers is now in a plan with a deductible of at least $2,000.

Working poor hit hardest: The survey also found that employers with many lower-wage workers — those earning $25,000 or less a year — tend to offer health benefits to a smaller share of their workforce than other employers and require higher worker contributions toward their premiums. At firms where at least 35% of employees make $25,000 or less, family premiums average about $17,600, some 15% less than the average at other firms. But those workers at lower-wage firms have an annual family contribution of over $7,000, compared to an average of under $6,000 at other firms. The result is that a far lower share of low-wage employees take the health benefits being offered. Only one in three workers at lower-wage businesses offering health benefits are covered, compared to 63% at other employers.

The Kaiser survey was conducted by telephone between January and July. It included 2,012 randomly selected employers with three or more workers.

For more on the survey results, See Kaiser’s summary of findings or the full report.