President Trump is making Palm Beach, Florida, his primary residence. The New York Times reported Thursday that the president and first lady filed documents in late September making their Mar-a-Lago estate their permanent home.

Trump has been a lifelong New Yorker, born and raised in Queens before moving to Manhattan. He has lived in Trump Tower since 1983, though he has spent more time at Mar-a-Lago than in New York since taking office.

Trump confirmed the change on Twitter, where he wrote: “I cherish New York, and the people of New York, and always will, but unfortunately, despite the fact that I pay millions of dollars in city, state and local taxes each year, I have been treated very badly by the political leaders of both the city and state. Few have been treated worse.”

Trump has never released his state or federal taxes, so his claims about paying "millions of dollars" in taxes can’t be verified.

The move is primarily about taxes: New York State has a top tax rate of nearly 9% and New York City has a top rate near 4%. The state also imposes a top estate tax rate of 16% for estates larger than $10.1 million. Florida, by contrast, has no state income tax or inheritance tax. “Trump’s move is not uncommon, especially among ultra-high net worth individuals over the age of 65,” MarketWatch’s Quentin Fottrell writes. “Billionaires tend to move out of states with estate taxes, according to a recent study by researchers at the University of California, Berkeley and the Federal Reserve Bank of San Francisco. The trend grows stronger as billionaires grow older, they said.”

And Trump might avoid his own tax hike: “Moving to Florida would potentially spare Trump one of the stiffest tax increases included in his 2017 overhaul of the code — a new $10,000 cap on state and local tax deductions,” Politico reports. “That hits wealthy people in blue states particularly hard, because they pay so much in taxes and therefore have a lot to deduct, although it’s unclear how much Trump pays.”

Trump mitigates some other risk in Florida: “Florida has a robust asset protection law that allows people to protect property, investments and other substantial assets in the event of unfavorable legal rulings,” Politico adds. “Lawyers in Florida tout former football player O.J. Simpson’s use of this law to dodge creditors by sinking his money into a large estate in Florida.”

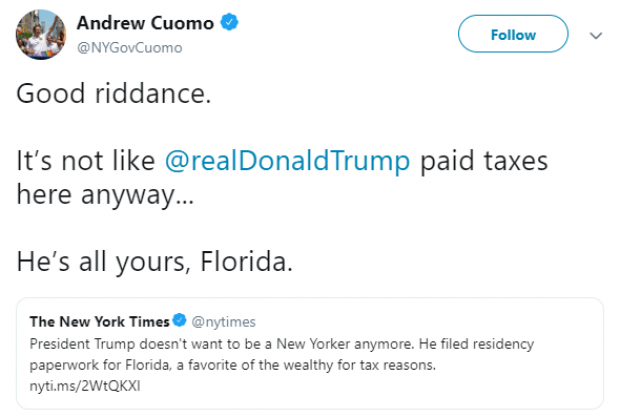

But Trump might not get an easy tax win:New York Gov. Andrew Cuomo was less than broken up about Trump’s move:

But the state's auditors might not be so willing to say he's a Florida resident. It will take more than filing a form to convince them that Trump shouldn't pay taxes in the state. “New York has a multipart test that takes in everything from where a taxpayer’s family is to where he or she keeps ‘items near and dear,’ like family heirlooms,” James Barron writes at The New York Times. “Auditors also examine whether a taxpayer continues to maintain a business in New York.”

What Trump does after he leaves office might be key:“Trump’s sons are running the Trump Organization while he is president, but if he returns to his role with the company after he leaves office, that could be a red flag for auditors – even if he is making decisions from his Palm Beach residence,” Brittany De Lea of FoxBusiness reports.