More than half of all seriously ill people on Medicare face financial hardships related to their illness, according to a new study in the journal Health Affairs.

A survey found that 53% of seriously ill Medicare beneficiaries reported trouble paying a medical bill, with prescription drugs and hospital bills posing the biggest hardships.

“Medicare is considered relatively good insurance,” the report says. “But traditional Medicare has well-known gaps in financial protection—notably, the lack of a cap on out-of-pocket spending.”

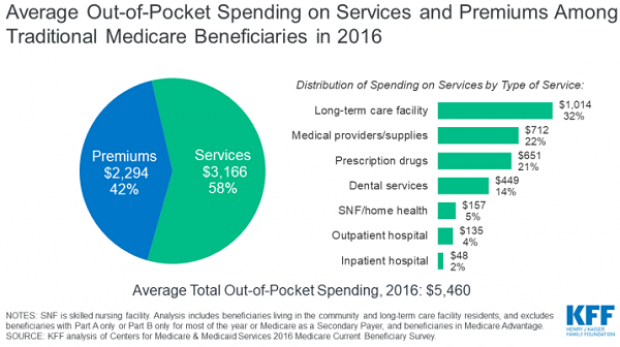

A separate study released this week by the Kaiser Family Foundation found that the average Medicare enrollee spent $5,460 out-of-pocket on health care in 2016, including premiums and services. A bit more than half of that was spent on medical and long-term care services ($3,166), on average, with the rest going toward premiums for Medicare and supplemental insurance ($2,294).

Spending varied considerably, though, for different groups. People over the age of 85 spent more than twice as much on average, at $10,307, and men spent about $600 more than women. And the roughly 20% of Medicare beneficiaries who lacked supplemental coverage were at greater risk of paying more.

“The fact that traditional Medicare does not have an annual out-of-pocket limit and does not cover certain services that older adults are more likely to need may undermine the financial security that Medicare provides, especially for people with significant needs and limited incomes,” the report says. “Addressing these gaps would help to alleviate the financial burden of health care for people with Medicare, although doing so would also increase federal spending and taxes.”