Christmas came early on Capitol Hill as lawmakers racing to finalize a nearly $1.4 trillion year-end deal to fund the government through September 30 loaded up their must-pass 2,300-plus-page package of spending bills with enough policy goodies to make sure almost everybody gets something to show off over the holidays.

The House on Tuesday passed two packages comprising the 12 required annual spending bills, sending them to the Senate, which is expected to approve them before leaving for the holidays.

“The number of issues handled in this bill is stunning. It contains major changes in health care policy, extends flood insurance, reauthorizes the Export-Import Bank for seven years, extends the terrorism insurance program and reauthorizes money to rebuild the Kennedy Center, and so much more,” Politico’s Playbook noted. “If you are a company or an entity with a legislative priority, and you couldn't get it in this year-end package, call your lobbyist for a chat. Or better yet, look for a new one.”

Republicans get to tout a $22 billion increase in defense spending, among other things, while Democrats can point to $25 million in federal funding for gun violence research, $425 million in election security grants and a $208 million increase for the Environmental Protection Agency.

And there’s much more. As part of the whirlwind dealmaking, congressional leaders and White House officials reached a late-night agreement Monday to extend some tax breaks through 2020, with longer extensions for provisions covering biodiesel production and short-line railroad maintenance.

“The deal would renew numerous tax provisions that either expired at the beginning of 2018 or this year, or were set to expire as of Jan. 1, 2020,” Roll Call reports. “They include deductions for mortgage insurance premiums, college costs and large medical expenses; excise tax breaks for craft brewers and distillers; credits for employer-paid family and medical leave, investors in low-income communities, and faster depreciation for racehorses and motor sports complexes, among others." Democrats failed to get some of what they had pushed for, though, including an expansion of tax breaks for renewable energy and electric vehicles and tax credits for low-income families.

In all, the package passed by the House Tuesday would increase spending by $49 billion over fiscal 2019 and raise deficits by $391 billion over 10 years, while the agreement to extend some lapsed or expiring tax breaks and other provisions will cost about $54 billion more.

While there were plenty of winners from the year-end scramble, here’s a look at a one that stood out — and one obvious loser.

1 Big Winner: The Health Care Industry

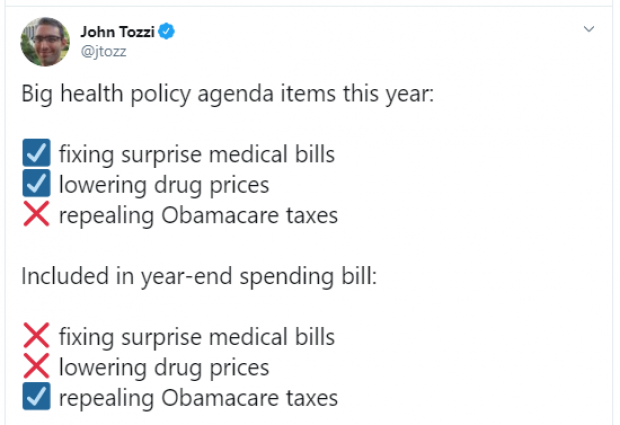

The repeal of the Affordable Care Act’s health insurance, medical device and “Cadillac” health plan taxes was a massive win for the health care industry. The industry also got at least a temporary reprieve on two other key issues as Congress failed to pass major legislation addressing surprise medical bills and prescription drug prices. (On the latter, the year-end deal includes legislation to help generic drugs get to market faster, but broader, more aggressive plans to lower drug prices have thus far failed to win consensus among lawmakers.)

These two tweets, from Bloomberg News reporter John Tozzi and billionaire philanthropist and health-care activist John Arnold sum up the scoreboard.

The question now is whether Congress will be able to tackle major legislation to lower drug prices and health-care costs in the middle of next year, with the November elections looming. By agreeing to fund community health-care centers and other health-care programs until May 22, lawmakers set themselves a new deadline to potentially address surprise medical bills and drug prices — and provided themselves with must-pass legislation that could be used as a vehicle for billing and prescription pricing reforms. “There are some reasons the strategy might work,” The Washington Post’s Paige Winfield Cunningham writes. “And there are plenty of reasons it might not.”

Sen. Lamar Alexander (R-TN), the chair of the Senate Committee on Health, Education, Labor and Pensions, said Monday that he intends to keep surprise medical billing at the top of Congress’s to-do list in 2020 until the legislation gets done. “Protecting patients from surprise billing is something almost everyone wants fixed,” he said in a statement. “The only people who don’t want this fixed are the people who benefit from these excessive fees, including the private equity groups which control three of the largest companies that handle billing and staffing for emergency rooms.”

1 Big Loser: Deficit Hawks

The relatively small group of lawmakers and budget watchdogs concerned about the rapid rise of the federal debt and deficit took it on the chin … again. Washington analysts had long forecast that deficit-financed increases in both defense and non-defense spending, as agreed to by Congress in July, was the surest path to a bipartisan budget deal for fiscal year 2020. But the burst of year-end dealmaking raised projected deficits significantly.

The repeal of three taxes meant to help pay for the Affordable Care Act combined with Congress’s renewal of a bundle of tax extenders will add $500 billion to the federal budget gap over 10 years once added interest costs are factored in, according to the Committee for a Responsible Federal Budget — and that’s on top of the effects of the 2017 tax cuts and the additional spending from the two-year budget deal passed this summer.

After the tax extenders legislation passed, CRFB President Maya MacGuineas tweeted, “What a bucket of garbage this bill is.”

It’s just the latest in a long string of setbacks for fiscal hawks. “The only things designed to reduce spending since the debt ceiling-created Super Committee nearly ten years ago have ALL been eliminated. The conversion of the Tea Party to born-again supply-side, modern monetary theorists is now complete...at least until a Democrat wins the White House when we suspect their inner deficit hawks will soar,” Cowen Washington Research Group analyst Chris Krueger wrote in a note to clients.