One of the more popular ideas for improving the finances of the Social Security system is to raise the maximum level of income that is exposed to FICA (Federal Insurance Contribution Act) taxes.

Currently, workers pay 6.2% in Social Security tax on just the first $132,900 of income, with employers paying the same, for a total tax of 12.4%. Analysts at the Penn Wharton Budget model released a study this week that estimated the revenue gains associated with raising the taxable income level.

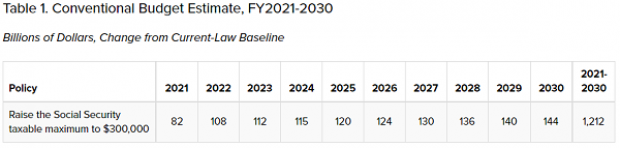

Researchers found that increasing the Social Security taxable maximum to $300,000 starting in 2021 would raise about $1.2 trillion in additional revenue over 10 years.

Families in the top 10% of the income distribution would bear most of the brunt of the tax hike, accounting for about 93% of the increased revenue. "The cost of this policy would fall largely on the upper-middle class and richest Americans," the researchers wrote. "After-tax income for those in the 95th to 99th percentage would fall by 1.3%, experiencing the greatest change of any income group," raising their payroll taxes by about $3,830 per year.

Penn Wharton also estimated that the economy would be 1.7% smaller in 2050 than it would have been without the tax increase. (Critics have raised questions about this aspect of the Penn Wharton economic model in the past, however, charging that negative GDP effects from tax hikes are simply assumed in the model.)