The coronavirus pandemic is likely to cause the world economy to sink into “its worst recession since the Great Depression, surpassing that seen during the global financial crisis a decade ago,” the International Monetary Fund said on Tuesday.

In its 2020 World Economic Outlook, the IMF projects that, as a result of what it calls “The Great Lockdown,” the global economy will shrink 3% this year before rebounding partially to grow 5.8% in 2021, less than pre-pandemic projections.

The U.S. economy is projected to contract 5.9% this year, the worst downturn since 1946, and then grow 4.7% in 2021. The projections are a sharp reversal of forecasts issued in January, when the IMF said it expected global growth to come in at 3.3% this year and U.S. growth to be 2%.

Gita Gopinath, the IMF’s chief economist, told reporters that under the best-case projection, global GDP would likely suffer a cumulative loss of about $9 trillion over two years, an amount greater than the economies of Germany and Japan combined.

Risks are to the downside: The IMF report noted that its new forecasts were subject to “extreme uncertainty” given the many factors that remain in question, including the path of the pandemic, progress in developing a vaccine and treatments, the effectiveness of containment measures and changes in people’s behavior and spending patterns. The forecasts assume that the pandemic will fade in the second half of the year and containment measures can be “gradually unwound,” allowing economic activity to normalize over time.

“Much worse growth outcomes are possible and maybe even likely,” the report said, noting that “risks to the outlook are on the downside.” A longer outbreak this year, a new outbreak in 2021 or a combination of the two could further reduce global GDP by 3% to 8%, the IMF said.

The report also noted that the United States and other advanced economies have implemented “swift and sizable” fiscal responses to the crisis, but that “fiscal measures will need to be scaled up if the stoppages to economic activity are persistent, or the pickup in activity as restrictions are lifted is too weak.”

Goldman Sachs sees highest unemployment since WWII: Goldman Sachs analysts are forecasting a similar level of pain, projecting that the global economic hit could be four time worse than the financial crisis, with second-quarter GDP plunging 11% year-over-year and 35% from the previous quarter on an annualized basis, according to CNBC. Goldman reportedly says that the U.S. unemployment rate could reach 15%, much higher than the IMF forecast of 10.4% — and Goldman warns that even its higher rate “understates the severity of the situation” given that many sidelined workers won’t be looking for jobs and thus won’t be counted in the data. On the bright side, Goldman reportedly projects a potentially “unprecedented” economic rebound, with third-quarter growth up 19% from the miserable second quarter followed by a 12% increase over the final three months of 2020.

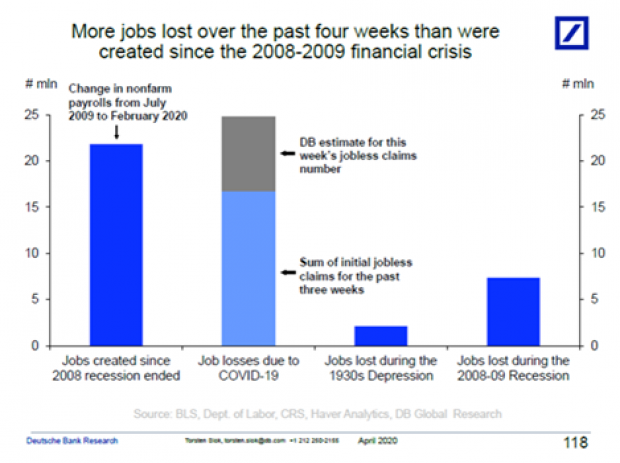

A decade of job gains lost in four weeks? We’ll get another reading of the turmoil in the labor market on Thursday, when the government announces the number of first-time unemployment claims filed last week. Torsten Slok, chief economist at Deutsche Bank Securities, forecasts another record-shattering number, with 8 million Americans filing new claims for unemployment benefits. “If our forecast is close to the mark, it would push the four-week total to almost 25 million, over 10 times the prior worst four-week period in the last 50-plus years,” Slok wrote to clients.

A number that big would have the unemployment rate peak at more than 17% this month — and it would mean that the U.S. has lost more jobs in the past four weeks that it gained since the 2008-2009 financial crisis. Slok’s projections might be high, though. Axios’s Dion Rabouin notes that economists Aaron Sojourner and Paul Goldsmith-Pinkham, expect a slightly less horrific 4.8 million claims this week — still enough to put the four-week total of job losses close to the 22 million total Slok says were created since July 2009.