The U.S. government is losing out on as much as $1 trillion a year or more in uncollected taxes, IRS Commissioner Charles Rettig told a Senate panel on Tuesday in calling for additional funding to help his “outgunned” agency pursue tax cheats and crack down on tax avoidance.

The last official measure of the “tax gap” — the annual difference between taxes owed and taxes paid — estimated the average annual shortfall at $441 billion from 2011 to 2013. Rettig told lawmakers that the gap has grown significantly since then, fueled by the growth of cryptocurrencies and foreign-source income as well as abuses of pass-through structures. “If you add those in, I think it would not be outlandish that the actual tax gap could approach, and possibly exceed, $1 trillion” a year, Rettig said.

The IRS is set to update its official estimate of the tax gap next year, but a 2019 analysis by former Treasury Secretary Larry Summers and Natasha Sarin, a University of Pennsylvania law professor who recently joined the Treasury Department, estimated the tax gap would total $7.5 trillion from 2020 through 2029. And a working paper published last month by the National Bureau of Economic Research found that the top 1% of taxpayers evade more taxes than previously thought, failing to report about 21% of their income to the IRS and underpaying taxes by some $175 billion a year.

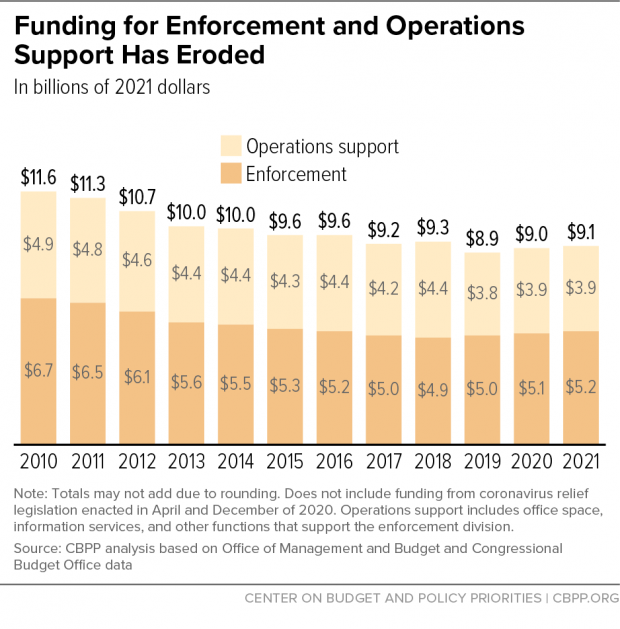

Rettig said that years of budget cuts have left the IRS with about 17,000 fewer enforcement staff than it had a decade ago and called on lawmakers to deliver “consistent, timely, adequate and multiyear funding.” (See the chart below from the liberal Center on Budget and Policy Priorities.) The IRS estimates that it could see a return of $5 to $7 for every $1 increase in its enforcement budget.

President Joe Biden has asked Congress to increase the IRS budget by about $1.3 billion, or 10.4%, for fiscal year 2022, including $900 million for ramped-up tax enforcement. The IRS “has seen some small budget increases in recent years, but the agency's funding level is still significantly below its 2010 peak when accounting for inflation,’ The Hill’s Naomi Jagoda reports.

Sen. Elizabeth Warren (D-MA) said she would soon propose mandatory funding for the agency, an idea that Rettig endorsed. “The solution isn’t just more funding, it’s about more stable funding that’s targeted toward catching the biggest fish and that’s protected from lobbyists that try to chip away at that funding,” Warren said.

Why it matters: “The tax gap has become an increasingly popular topic on Capitol Hill because of growing budget deficits and federal debt,” The Wall Street Journal’s John McCormick notes. At Tuesday’s hearing, senators of both parties expressed support for narrowing the gap.

Senate Finance Committee Chair Ron Wyden (D-OR) tanked Rettig for delivering what he said was a “wake-up call” about the scale of tax cheating taking place. “My hope is, on the basis of the number of members who brought this up this morning, we can have an aggressive, proactive effort that reflects the seriousness of this,” Wyden said.

Sen. Mike Crapo of Idaho, the top Republican on the committee, said: “If there are those that are cheating on their taxes and causing us to have such a large tax gap, which I don’t doubt, we should address that.”