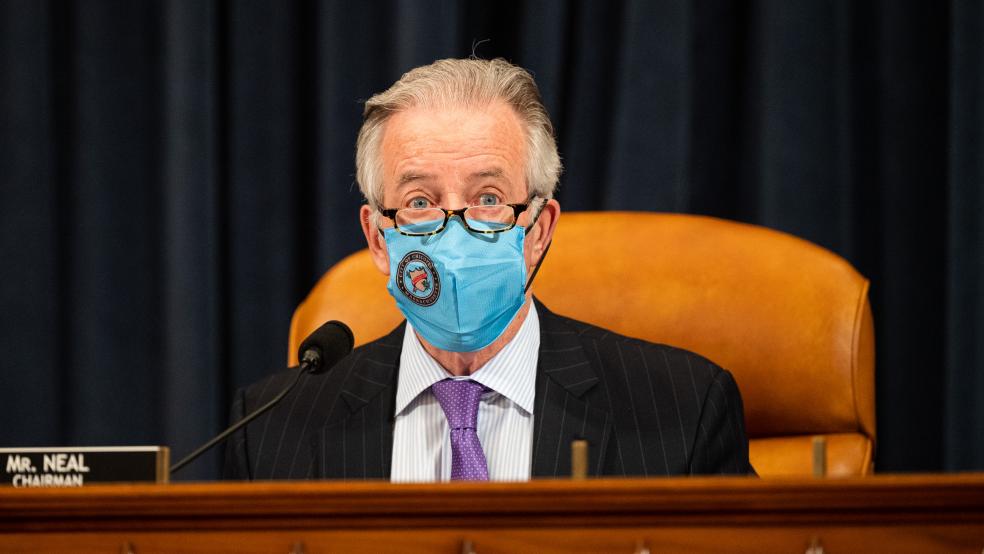

In another sign of just how challenging it may be for President Biden to win support for his proposed tax hikes even among Democrats, Bloomberg News reports that staffers for House Ways and Means Chairman Richard Neal have floated an idea to chip away at a key element of Biden’s plan to raise taxes on the wealthy.

Biden has proposed ending the so-called “step up in basis” that allows heirs to reset the cost basis of inherited assets based on market value at the time of inheritance. As it now stands, that step up in basis enables heirs to avoid paying capital gains taxes on years’ worth — or decades’ worth — of appreciation in asset values after their initial purchase, allowing accumulated gains to be passed down, untaxed, from generation to generation, which the White House and others argue exacerbates inequality.

Biden has proposed raising the capital gains tax rate for households making over $1 million from 20% to 39.6%, putting it on par with the tax rate on earned income. In tandem with that, he has proposed eliminating the step up in basis for gains over $1 million (or $2.5 million per couple), with exceptions for family-owned businesses and farms. The Tax Policy Center estimates that, in all, Biden’s changes to the capital gains tax would raise about $370 billion over a decade. The more conservative-leaning Tax Foundation estimates that the changes would raise about $213 billion over a decade.

Staffers for Neal, head of the House’s tax-writing committee, reportedly have raised another option: allowing heirs to defer their capital gains tax bills for as long as they hold the inherited assets. Whereas under Biden’s plan, the transfer of assets would be a taxable event, Neal’s alternative would mean that heirs would only face a tax bill if or when the inherited assets are sold.

The change would ward off criticisms that Biden’s plan could create a cash crunch for some people who inherit hard assets like real estate or businesses and force those heirs to immediately sell off their inheritances. On the other hand, the idea from Neal’s staff “would give beneficiaries of large estates the incentive not to sell, known as the lock-in effect, and it would mean bringing in less money to pay for Biden’s $1.8 trillion American Families Plan,” Bloomberg’s Nancy Cook and Laura Davison write.

Neal’s staff reportedly was just presenting options rather than a definitive proposal, and other Democrats remain intent on ending stepped-up basis. “By allowing the richest people in American to avoid paying taxes on their capital gains, stepped-up basis is a seminal driver of the economic inequality that is slowly poisoning the United States,” Rep. Bill Pascrell (D-NJ), a member of the Ways and Means Committee, said in a statement to Bloomberg. “I am always open to discussing avenues to strengthen legislation that addresses tax inequities. But our focus remains on sealing shut this loophole.”

Why it matters: Biden has proposed ways to pay for his $4.1 trillion in newly proposed spending, but Republicans have rejected the idea of tax increases — and some Democrats have major concerns about various parts of Biden’s tax plans, ranging from his corporate tax hike to the capital gains changes. Democrats will have to overcome their own intraparty differences to pull together any package of tax increases.